The Latest Polls

There was yet more movement in the FT’s poll tracker over the last week, as the news wires delivered more coverage on campaigning.

According to the latest FT’s interactive Calculator and polling data, Presidential hopeful Biden saw his lead widen, following a marked narrowing in the week prior.

The Challenger

In the last week, Biden saw his projected Electoral College vote count rise to 280 as at 17th September. As at 10th September, Biden had seen his projected haul slide to 263 Electoral College votes.

Significantly, the projection of more than the minimum 270 votes needed to win was a more positive outcome. In the week prior, Biden had seen his haul fall below the magic number of 270 required to take the Oval Office.

While the increase in projected Electoral College votes was positive, Biden’s haul still sat below a 5th August haul of 308.

In fact, Biden saw a downward trend through early September until this week’s rise.

Looking at the breakdown of the votes, however, it has been less conclusive.

Of the 298 votes, Biden only has 203 solid votes and 95 leaning votes. Taking away the 95 votes leaves Biden well short of the 270.

While this may be negative in terms of optics, Biden has in fact seen leaning votes decline in recent weeks.

Back on 5th August, when the FT projected a haul of 308 Electoral College votes, leaning votes had stood at 114. Solid votes had stood at 194. So, Biden should take heart in the recent widening in the gap.

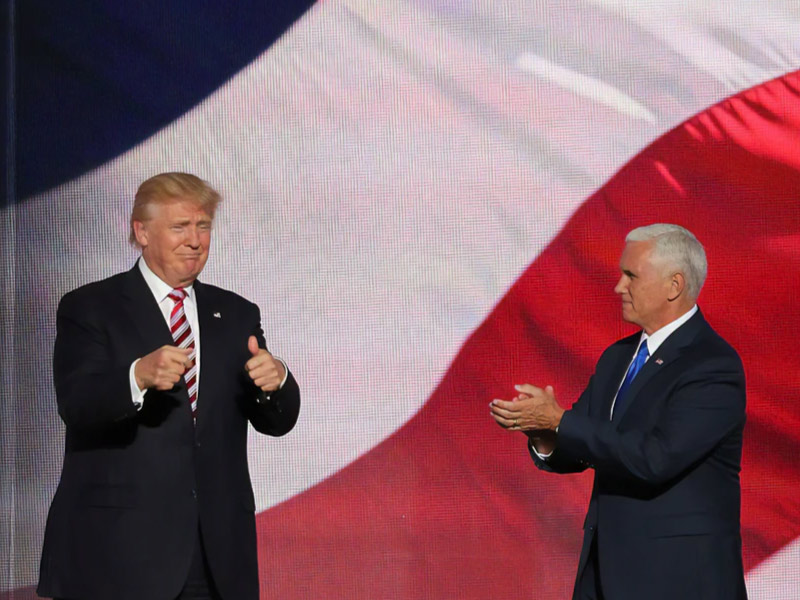

Incumbent Trump

For the U.S President, the FT projects a haul of 131 Electoral College votes. This was up from a haul of 122 back on 5th August and last week’s projection of 122 Electoral College votes.

While optically these figures can be considered positive, the reality is that Trump has seen his solid vote projection slip.

As at 5th August, Trump had 80 solid votes and 42 leaning votes. On 10th September, solid votes slipped to 77, while leaning votes increased by 3 to 45.

The latest figures, as at 17th September, has Trump with 54 leaning votes. It is the leaning votes that have driven up Trump’s total vote haul.

Taking away the leaning vote tally, Trump looks to have slim to no chance of winning the 2020 Election.

As we experienced back in 2016, however, it is not so simple.

Leaning votes in favor of Biden and Trump total 131 Electoral College votes. Then there are the fence-sitters, classified as Toss-ups. Toss-ups stood at 127 as at 17th September.

As at 10th September Toss-ups had stood at 153. Back on 5th August, the number was a measly 108…

The upward trend in toss-ups suggests that voters are becoming less certain on which way to cast their ballot on Election Day.

The Toss-up States

At the time of writing, the FT had 127 states sitting on the fence. Classified as toss-up states, these are states where the difference in poll numbers between Biden and Trump is less than 5 percentage points.

6 states fell within the toss-up category, down from 8 states in the week prior.

The 6 states included Texas (38 E.C votes), Florida (29 E.C votes), Ohio (18 E.C votes), Georgia (16 E.C votes), N. Carolina (15 E.C votes), and Arizona (11 E.C votes).

Michigan (16 E.C votes) and Maine 2 (1 E.C vote) shifted in favor of Biden in the week, while Trump drew South Carolina (9 E.C votes).

For U.S President Trump to take the 2020 Presidential Election, he would need to take all of the 127 Electoral College votes sitting on the fence. Even with the 127, however, Trump would still come up short of the magic number of 270. This is assuming of course that all of the 54 leaning Electoral College votes go in his favor.

For Joe Biden, he could afford to give up 10 leaning Electoral College votes from his leans but it would set a dangerous precedent.

On face value, therefore, the odds remain heavily stacked in Biden’s favor, supported by the latest widening in the poll tracker.

Key States

If we look at the key U.S states that tend to be election barometers:

Missouri continues to lean in favor of Trump and the Republicans, with Kansas also leaning in Trump’s favor.

For Biden, Illinois, New Mexico, and Oregon remain solid blues, with New Hampshire and Pennsylvania leaning in favor of Biden. Biden will also be delighted to claw back Michigan in the week. Michigan had sat on the fence on 10th September.

The Road Ahead

We are expecting market sensitivity to the polls and projections to begin to rise in the coming weeks. In fact, we should see volatility pick up ahead of the debates that kick off next month,

As the polls begin to swing with a little more vigor, the markets will likely respond to the uncertainty.

For Biden, it remains an election to lose. For the U.S President, however, there is a lot of work to do.

Changing the narrative on COVID-19 and on the Black Lives Matter movement remain key. Projecting and deflecting may not be enough when considering labor market conditions.