After the U.S. dollar, the euro and yen are the most traded currencies.

And like the U.S. dollar, the euro and yen are also held as reserve currencies by different countries.

So this makes the euro and yen crosses the most liquid outside of the U.S. dollar-based “majors.”

Trading the Euro Crosses

The most popular EUR crosses are EUR/JPY, EUR/GBP, and EUR/CHF.

News that affects the euro or Swiss franc will be felt more in EUR crosses than EUR/USD or USD/CHF.

U.K. news will greatly affect EUR/GBP.

Oddly enough, U.S. news plays a part in the movement of the EUR crosses. U.S. news makes strong moves in GBP/USD and USD/CHF.

This not only affects the price of the GBP and CHF against the USD, but it could also affect the GBP and CHF against the EUR.

A big move higher in the USD will tend to see a higher EUR/CHF and EUR/GBP and the same goes for the opposite direction.

Confused? Ok ok…let’s break this down.

Let’s say that the U.S. shows positive economic data causing the USD to rise.

This means that GBP/USD would fall, driving the price of the GBP down. At the same time, USD/CHF would rise, also driving the price of the CHF down.

The drop in GBP price would then cause EUR/GBP to rise (since traders are selling off their GBP).

The drop in CHF price would also cause EUR/CHF to rise (since traders are selling off their CHF).

Conversely, this would also work in the opposite direction if the U.S. showed negative economic data.

Trading the Yen Crosses

The JPY is one of the more popular cross currencies and it is basically traded against all of the other major currencies.

EUR/JPY has the highest volume of the JPY crosses according to the latest Triennial Central Bank Survey from the Bank for International Settlements.

GBP/JPY, AUD/JPY, and NZD/JPY are attractive carry trade currencies because they offer the highest interest rate differentials against the JPY.

When trading JPY currency cross pairs, you should always keep an eye out on the USD/JPY.

When key levels are broken or resisted on this pair, it tends to spill over into the JPY cross pairs.

For example, if USD/JPY breaks out above a key resistance area, it means that traders are selling off their JPY.

This could prompt the selling of the JPY against other currencies. Therefore you could expect to see EUR/JPY, GBP/JPY, and other JPY crosses to rise as well.

The CAD/JPY

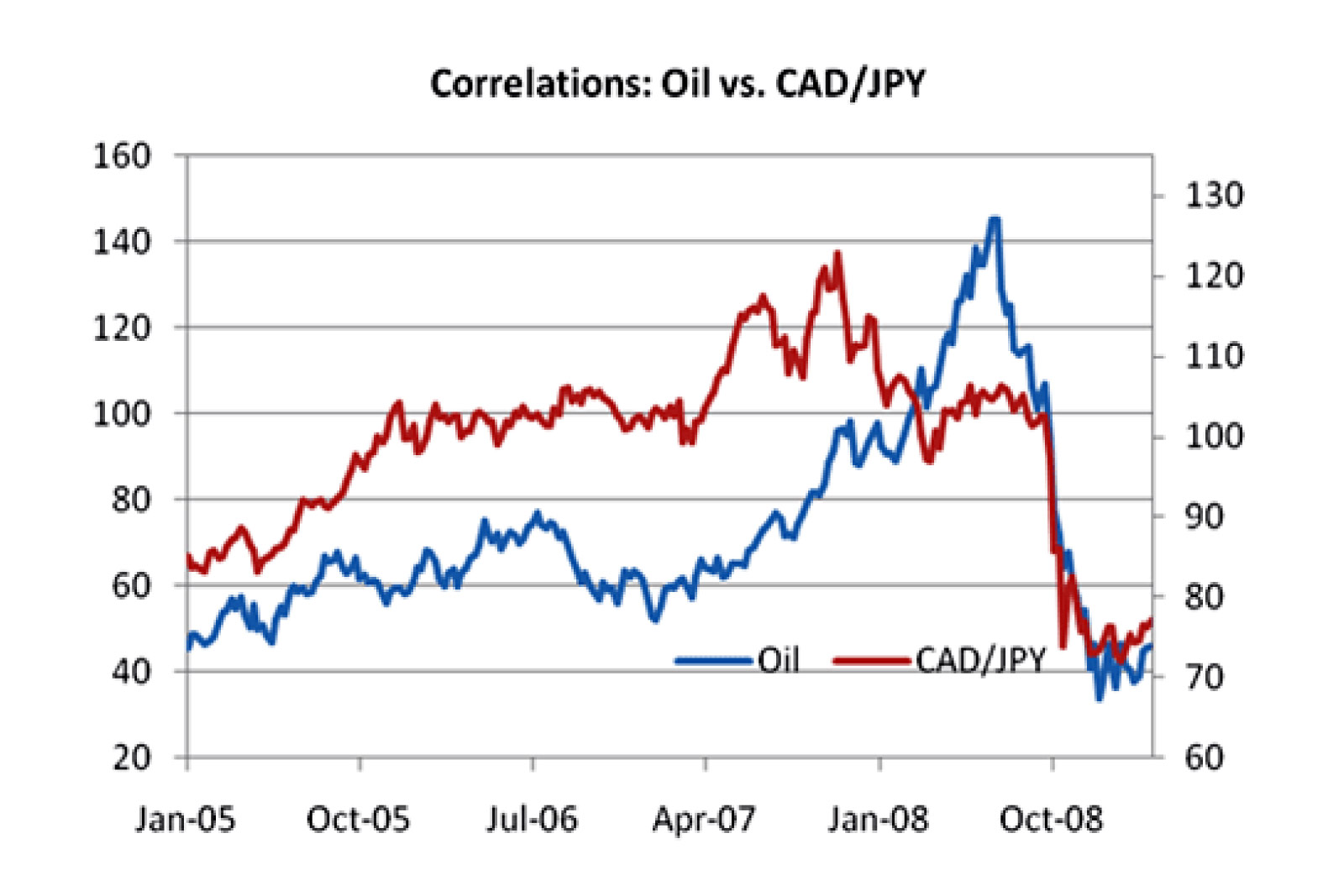

Over recent years, this currency cross has become very popular, becoming highly correlated with the price of oil.

Canada is the second-largest owner of oil reserves and has benefited from the rise of oil prices.

On the other hand, Japan is heavily reliant on the importing of oil. In fact, over 99% of Japan’s crude oil is imported as it has almost no native oil reserves.

These two factors have caused an 87% positive correlation between the price of oil and CAD/JPY.