Step 1:

Open up the address below in your web browser.(http://www.cftc.gov/marketreports/commitmentsoftraders/index.htm)

Step 2:

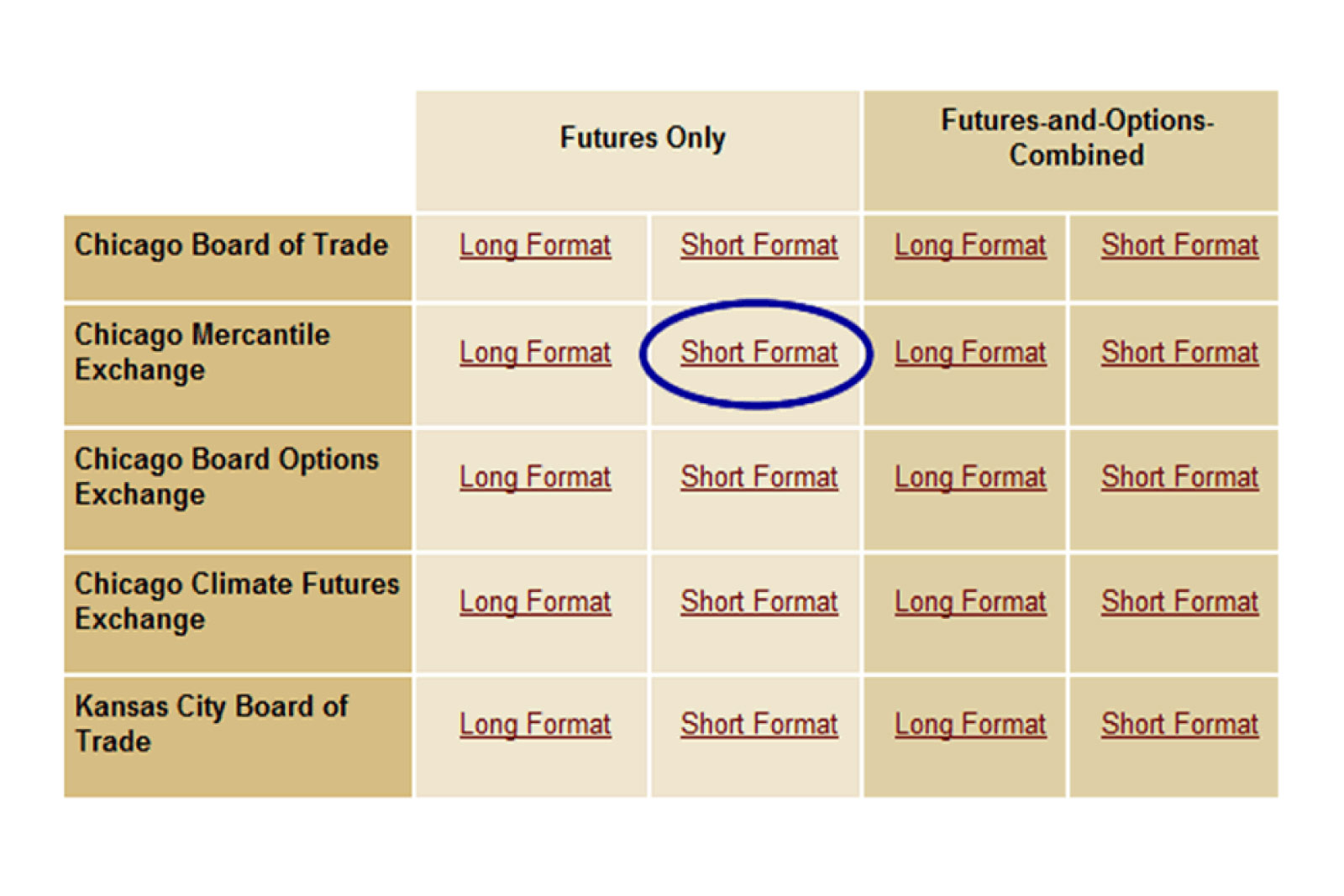

Once the page has loaded, scroll down a couple of pages to the “Current Legacy Report” and click on “Short Format” under “Futures Only” on the “Chicago Mercantile Exchange” row to access the most recent COT report.

Step 3:

It may seem a little intimidating at first because it looks like a big giant gobbled-up block of text but with a little bit of effort, you can find exactly what you’re looking for.

Just press CTRL+F (or whatever the find function is of your browser) and type in the currency you want to find.

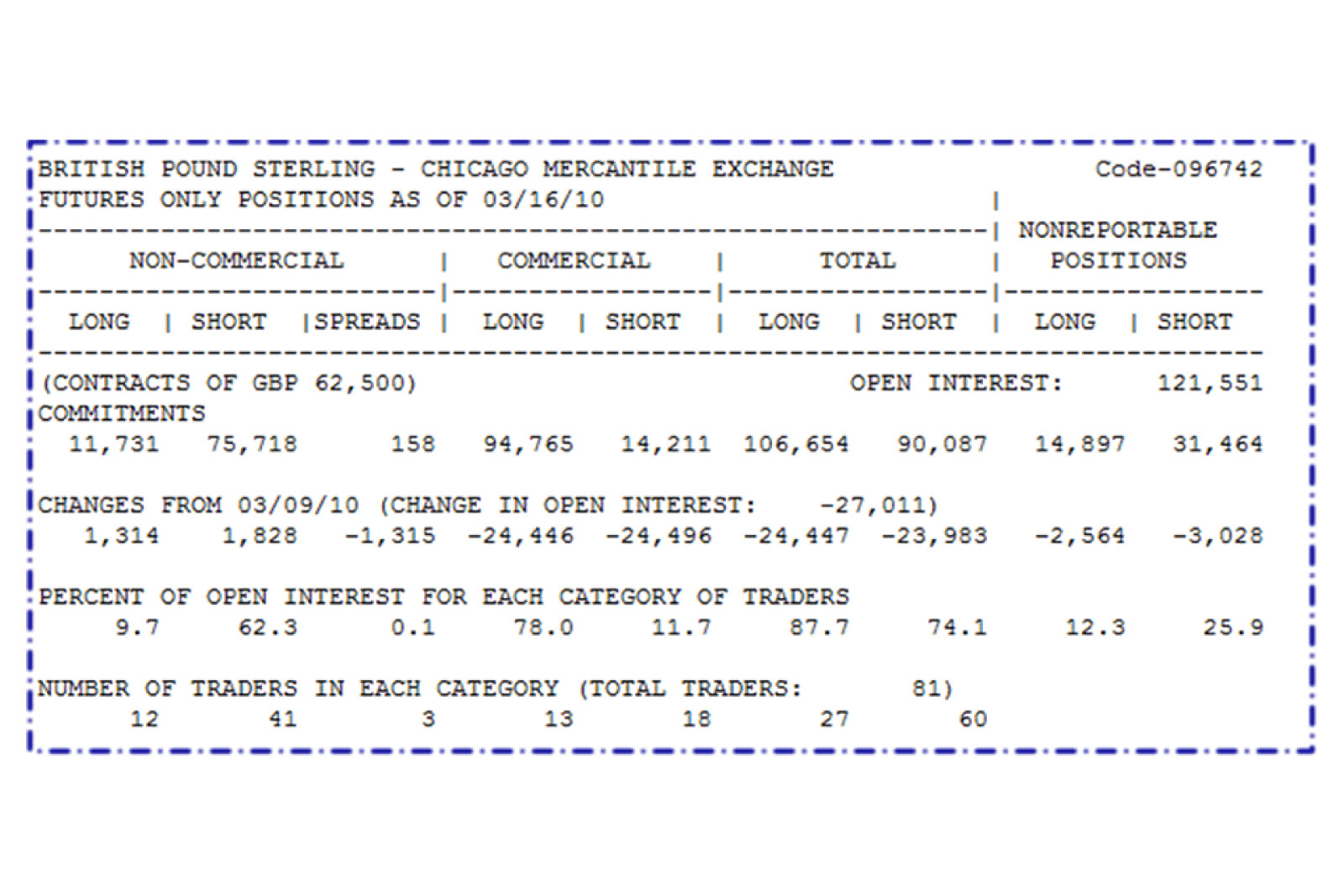

To find the British Pound Sterling, or GBP, for example, just search up “Pound Sterling” and you’ll be taken directly to a section that looks something like this:

Yowza! What the heck is this?! Don’t worry. We’ll explain each category below.

- Commercial: These are the big businesses that use currency futures to hedge and protect themselves from too much exchange rate fluctuation.

- Non-Commercial: This is a mixture of individual traders, hedge funds, and financial institutions. For the most part, these are traders who looking to trade for speculative gains. In other words, these are traders just like you who are in it for the Benjamins!

- Long: That’s the number of long contracts reported to the CFTC.

- Short: That’s the number of short contracts reported to the CFTC.

- Open interest: This column represents the number of contracts out there that have not been exercised or delivered.

- Number of traders: This is the total number of traders who are required to report positions to the CFTC.

- Reportable positions: The number of options and futures positions that are required to be reported according to CFTC regulations.

- Non-reportable positions: The number of open interest positions that do not meet the reportable requirements of the CFTC like retail traders.

If you want to access all available historical data, you can view it here.

You can see a lot of things in the COT report but you don’t have to memorize all of it.

As a budding trader, you’ll only be focusing on answering the basic question:

“Wat da dilly on da market yo?!”

Translation: “What’s the market feeling this week?“