What does “Stop Out Level” or “Stop Out” mean?

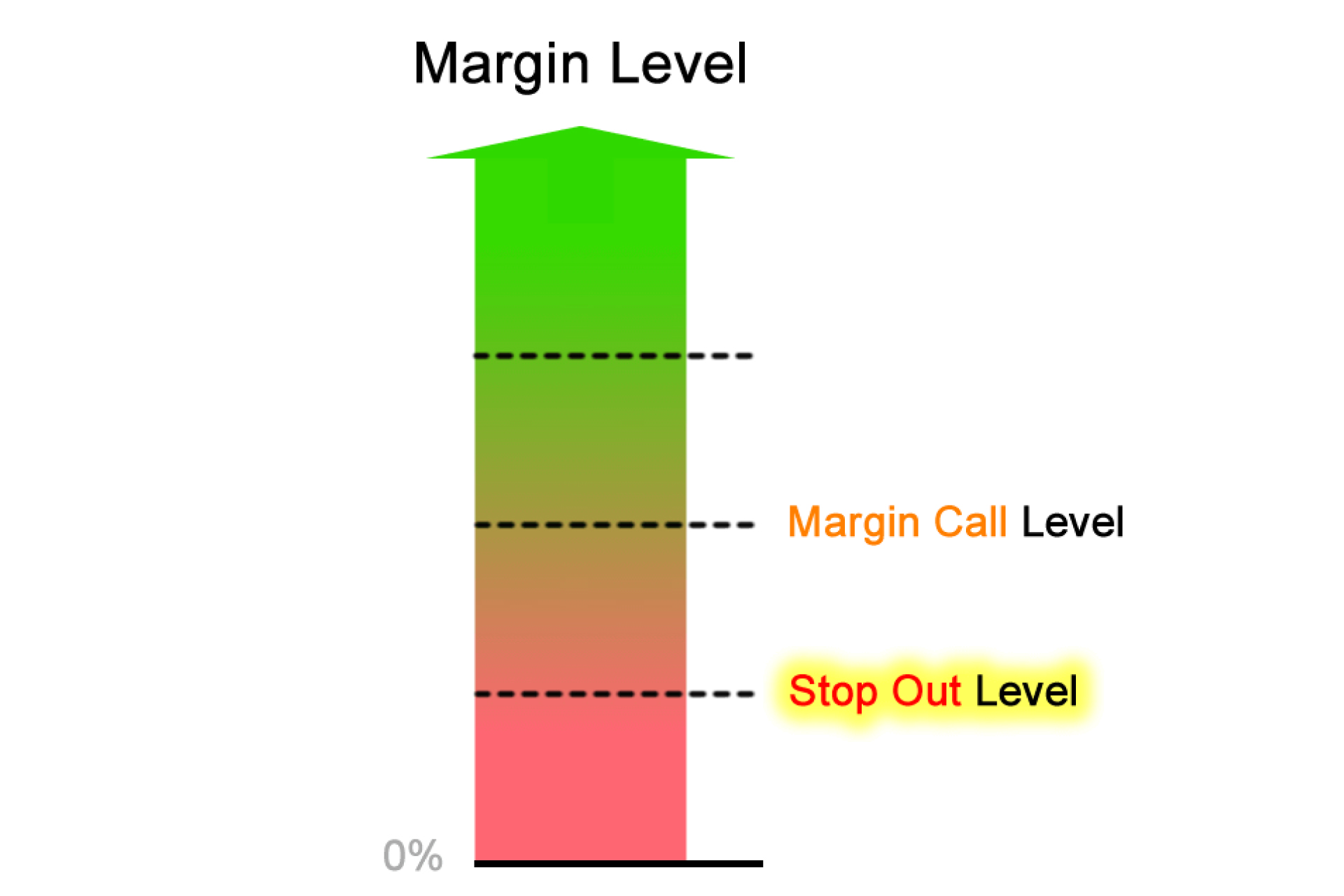

The Stop Out Level is similar to the Margin Call Level, which was covered in the previous lesson, except that it’s much worse!

In forex trading, a Stop Out Level is when your Margin Level falls to a specific percentage (%) level in which one or all of your open positions are closed automatically (“liquidated”) by your broker.

This liquidation happens because the trading account can no longer support the open positions due to a lack of margin.

More specifically, the Stop Out Level is when the Equity is lower than a specific percentage of your Used Margin.

If this level is reached, your broker will automatically start closing out your trades starting with the most unprofitable one until your Margin Level is back above the Stop Out Level.

If your Margin Level is at or below the Stop Out Level, the broker will close any or all of your open positions as quickly as possible in order to protect you from possibly incurring further losses.

This act of closing your positions is called a Stop Out.

Keep in mind that a Stop Out is not discretionary. Once the liquidation process has started, it is usually not possible to stop it since the process is automated.

Your broker’s customer support team will probably NOT be able to help you aside from lending an ear while you weep loudly over the phone.

The Stop Out Level is also known as the Margin Closeout Value, Liquidation Margin, or Minimum Required Margin.

Example: Stop Out Level at 20%

Let’s say your forex broker has a Stop Out Level at 20%.

This means that your trading platform will automatically close your position if your Margin Level reaches 20%.

Stop Out Level = Margin Level @ 20%

Let’s continue with the example from the previous lesson, What is a Margin Call Level?

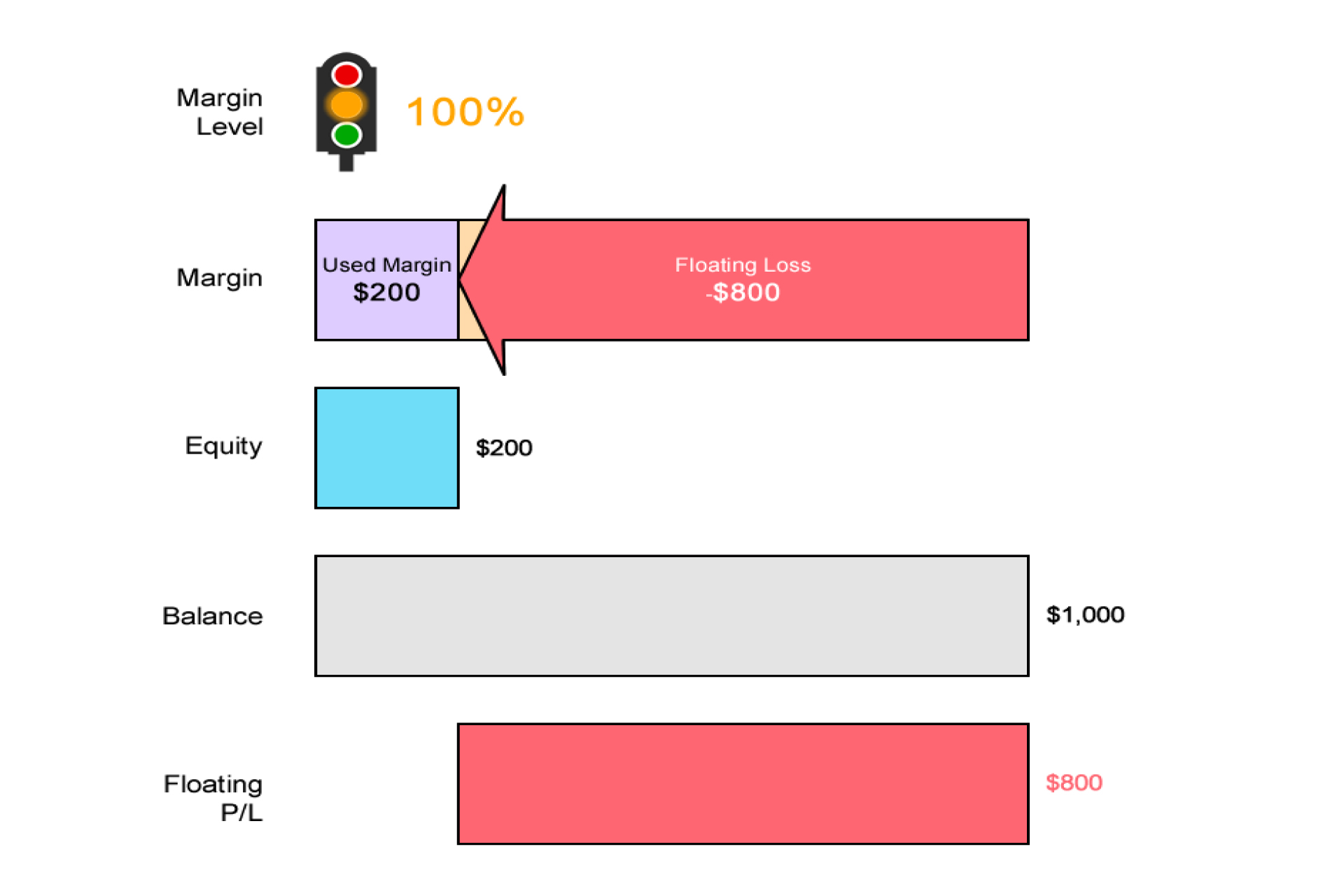

You’ve already received a Margin Call when the Margin Level had reached 100% but still decide not to deposit more funds because you think the market will turn.

Not only are you a sucky trader, but you’re a crazy trader also. A sucky crazy trader.

Anyways, your sucky crazy self ends up…absolutely WRONG.

The market continues to fall.

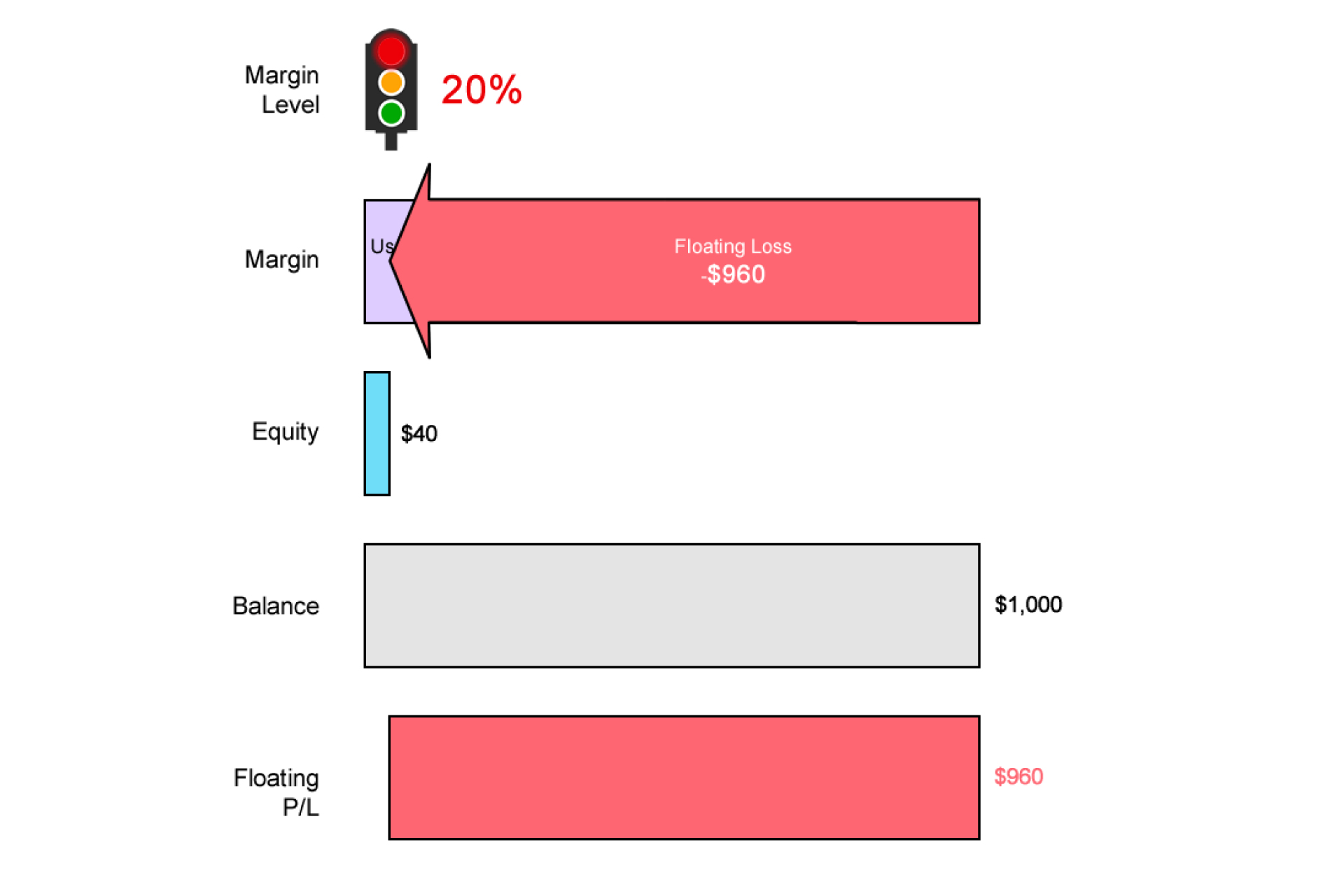

You’re now down 960 pips.

At $1/pip, you now have a floating loss of $960!

This means your Equity is now $40.

Equity = Balance + Floating P/L

$40 = $1000 – $960

Your Margin Level is now 20%.

Margin Level = (Equity / Used Margin) x 100%

20% = ($40 / $200) x 100%

*Used Margin can’t go below $200 because that’s the Required Margin that was needed to open the position in the first place.

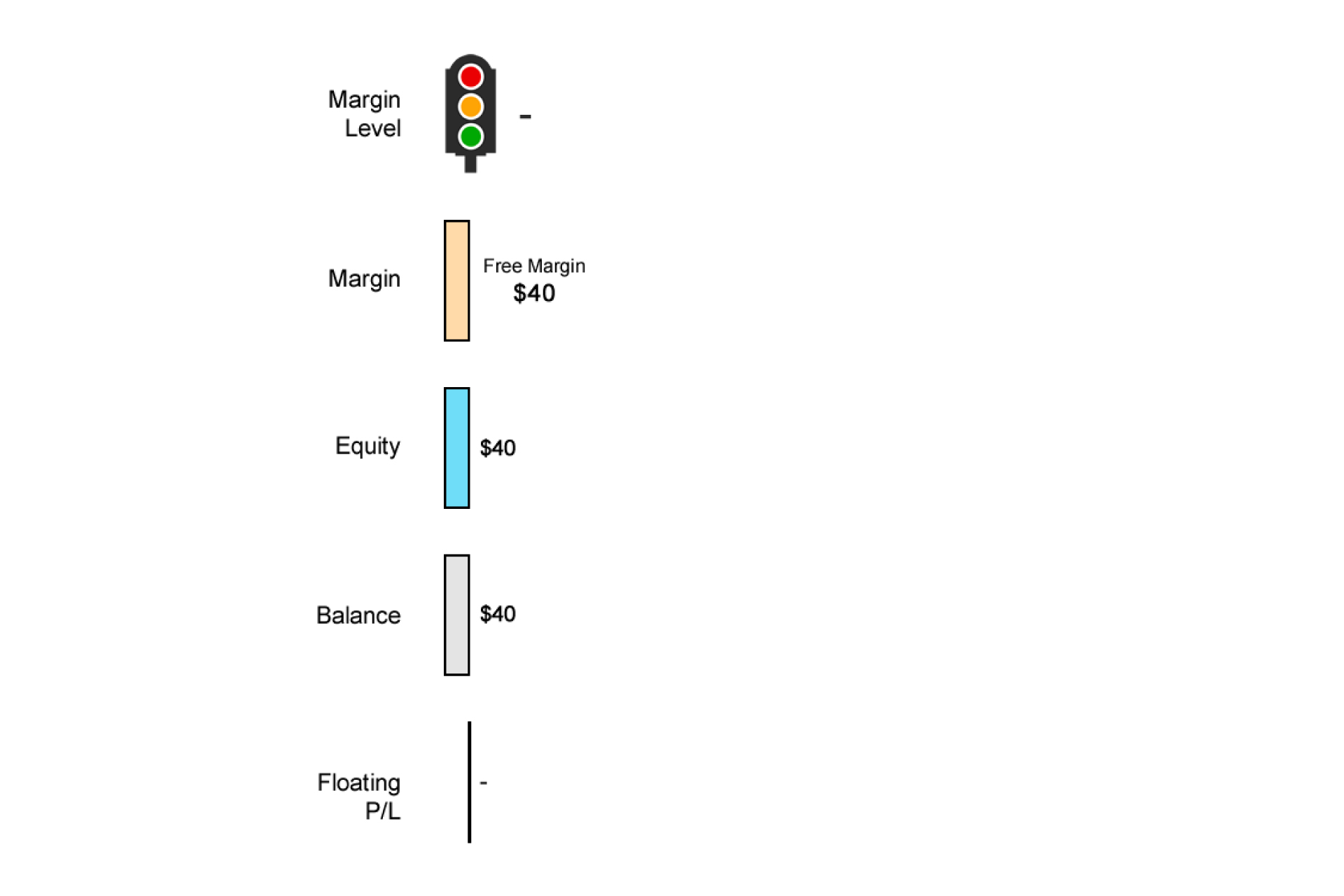

At this point, your position will be automatically closed (“liquidated”).

When your position is closed, the Used Margin that was “locked up” will be released.

It will become Free Margin.

The end result for you will be depressing though.

Your floating loss of $960 will be “realized”, and your new Balance will be $40!

Since you don’t have any open trades, your Equity and Free Margin will also be $40.

Here’s how your account metrics would look like in your trading platform at each Margin Level threshold:

| Margin Level | Equity | Used Margin | Free Margin | Balance | Floating P/L | |

| Margin Call Level | 100% | $200 | $200 | $0 | $1,000 | -$800 |

| Stop Out Level | 20% | $40 | $200 | $0 | $1,000 | -$960 |

| Stop Out (Liquidation) | – | $40 | – | $40 | $40 | – |

If you experience a Stop Out and see the aftermath in your account, this is how your eyes feel…

If you had multiple positions open, the broker usually closes the least profitable position first.

Each position that is closed “releases” Used Margin, which increases your Margin Level.

But if closing this position is still not enough to get back the Margin Level above 20%, your broker will continue to close positions until it does.

The Stop Out Level is meant to prevent you from losing more money than you have deposited.

If your trade continued to keep losing, eventually, you’d have no more money in your account and you’d end up with a negative account balance!

Brokers would prefer not to have to come knocking on your door with a baseball bat to collect the unpaid balance, so a Stop Out is meant to try and… STOP… your Balance from going negative.

What if I have multiple positions open?

The example above covered the scenario with you trading a single position. But what if you had MULTIPLE positions open?

Hmmm.

Sounds like you love gambling so here’s an example of how the liquidation process would work if you had two or more positions open.

Each broker has its own specific liquidation process so be sure to check with yours. BUT this is a popular approach and will at least give you a good idea of what kind of horror you might experience if you’re trading too BIG.

Let’s pretend the Stop Out level is at 100%.

If at any point, the Margin Level drops below 100% of the margin required.. you will experience an AUTO LIQUIDATION of the position that has the largest unrealized loss! ?

So if you have multiple positions, the open position with the greatest unrealized loss is closed first, followed by the next largest losing position, followed by the next largest losing position, and so on, UNTIL the Margin Level (maintenance margin) is back to 100% or higher.

Depending on the size and unrealized P&L of the open positions, all your open positions could be liquidated in order to meet the margin requirement! ?????

Remember, YOU, and YOU alone, are responsible for monitoring your account and making sure you are maintaining the required margin at all times to support your open positions.

You’ve been warned. Don’t be crying to your broker when your position gets auto-liquated.

You can still cry of course. But only in front of a mirror. ?

Now that we’ve covered all the important metrics that you need to know in your trading platform, let’s take everything you’ve learned so far about margin trading and put it all together using different trading scenarios.