Managing and preserving your trading capital is your most important job as a trader.

If you lose all of your trading capital, there is no way you can make back the lost amount, you’re out of the trading game.

If you make pips, you got to be able to keep those pips and not give them back to the market.

But let’s face it. The market will always do what it wants to do, and move the way it wants to move.

Every day is a new challenge, and almost anything from global politics, major economic events, to central bank rumors can turn currency prices one way or another faster than you can snap your fingers.

This means that each and every one of us will eventually take a position on the wrong side of a market move.

Being in a losing position is inevitable, but we can control what we do when we’re caught in that situation.

You can either cut your loss quickly or you can ride it in hopes of the market moving back in your favor.

Of course, that one time it doesn’t turn your way could blow out your account and end your budding trading career in a flash.

The saying, “Live to trade another day!” should be the motto of every trader on Newbie Island because the longer you can survive, the more you can learn, gain experience, and increase your chances of success.

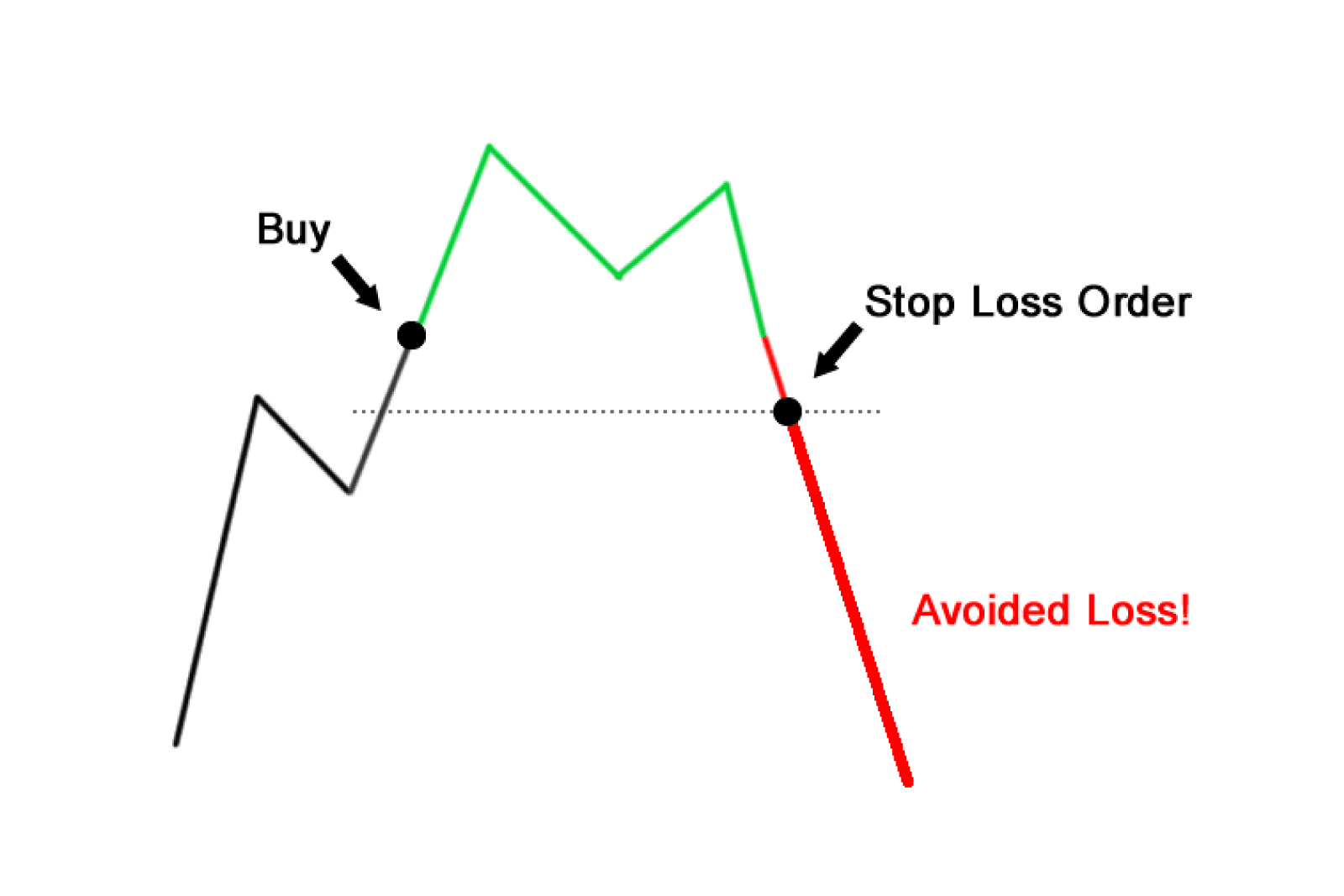

This makes the trade management technique of “stop losses” a crucial skill and tool in a trader’s toolbox.

Having a predetermined point of exiting a losing trade not only provides the benefit of cutting losses so that you may move on to new opportunities, but it also eliminates the anxiety caused by being in a losing trade without a plan.

Your stop loss point should be the “invalidation point” of your trading idea.

Remember that time you went on a blind date? At some point, you had enough and just wanted to leave. That’s a stop loss in the dating game.

But a stop loss in the trading game isn’t that much different.

When the price hits this point, it should signal to you “It’s time to get out buddy!”

Less stress is good, right?

Of course, it is, so let’s move on to different ways to cut ’em losses quick!

Now before we get into stop loss techniques, we have to go through the first rule of setting stops.

Why Use a Stop Loss?

The main purpose of a stop loss is to ensure that losses won’t grow too BIG.

While this might sound obvious, there is a little more to this than you might assume.

Imagine two traders, Kylie and Kendall.

They both trade the same exact trading strategy with the only difference being their stop loss size.

| Kylie | Kendall | |

| Stop Loss Size (% of total account balance) |

10% | 2% |

For each trade, the trading strategy only has two possible outcomes:

- A profit.

- A loss.

This means that the strategy exits a trade when the stop loss (SL) is hit OR when the profit target (PT) is hit.

Now imagine that both Kylie and Kendall go on a losing streak.

They both lose TEN trades in a row!

Kendall’s account will be down 20% BUT Kylie’s account has blown her account!

Kylie is out of the forex game.

Using stop losses decrease the risk of blowing your account and work to protect your trading capital.

In the next section, we’ll discuss the many different ways of setting stops.

There are four methods you can choose from:

- Percentage stop

- Volatility stop

- Chart stop

- Time stop

Ready? Let’s get started!