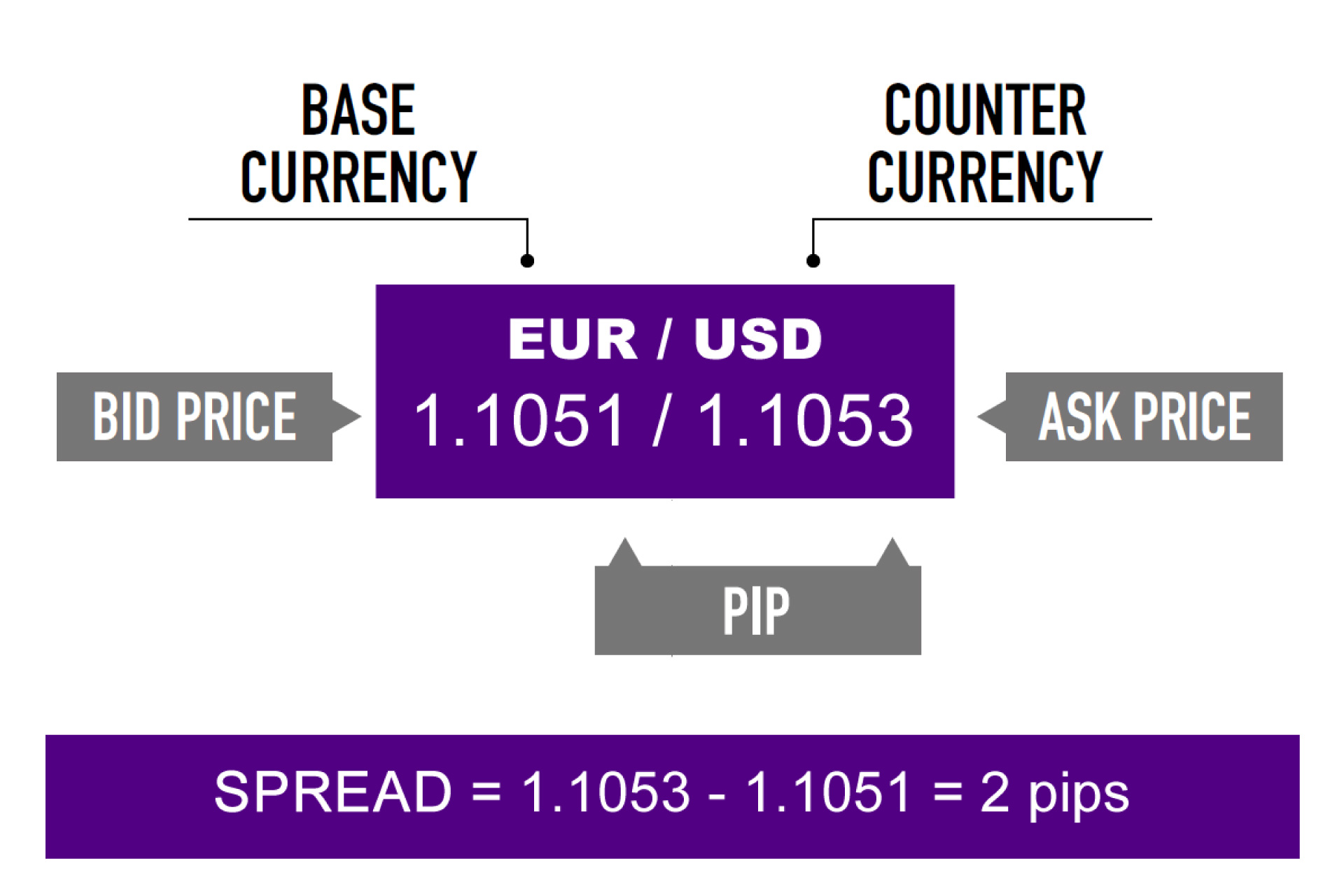

Forex brokers will quote you two different prices for a currency pair: the bid and ask price.

The “bid” is the price at which you can SELL the base currency.

The “ask” is the price at which you can BUY the base currency.

The difference between these two prices is known as the spread.

Also known as the “bid/ask spread“.

The spread is how “no commission” brokers make their money.

Instead of charging a separate fee for making a trade, the cost is built into the buy and sell price of the currency pair you want to trade.

From a business standpoint, this makes sense. The broker provides a service and has to make money somehow.

- They make money by selling the currency to you for more than they paid to buy it.

- And they also make money by buying the currency from you for less than they will receive when they sell it.

- This difference is called the spread.

It’s just like if you were trying to sell your old iPhone to a store that buys used iPhones. (A smartphone with only two rear cameras? Yuck!)

In order to make a profit, it will need to buy your iPhone at a price lower than the price it’ll sell it for.

If it can sell the iPhone for $500, then if it wants to make any money, the most it can buy from you is $499.

That difference of $1 is the spread.

So when a broker claims “zero commissions” or “no commission”, it’s misleading because while there is no separate commission fee, you still pay a commission.

It’s just built into the bid/ask spread!

How is the Spread in Forex Trading Measured?

The spread is usually measured in pips, which is the smallest unit of the price movement of a currency pair.

For most currency pairs, one pip is equal to 0.0001.

An example of a 2 pip spread for EUR/USD would be 1.1051/1.1053.

Currency pairs involving the Japanese yen are quoted to only 2 decimal places (unless there are fractional pips, then it’s 3 decimals).

For example, USD/JPY would be 110.00/110.04. This quote indicates a spread of 4 pips.

What Types of Spreads are in Forex?

The type of spreads that you’ll see on a trading platform depends on the forex broker and how they make money.

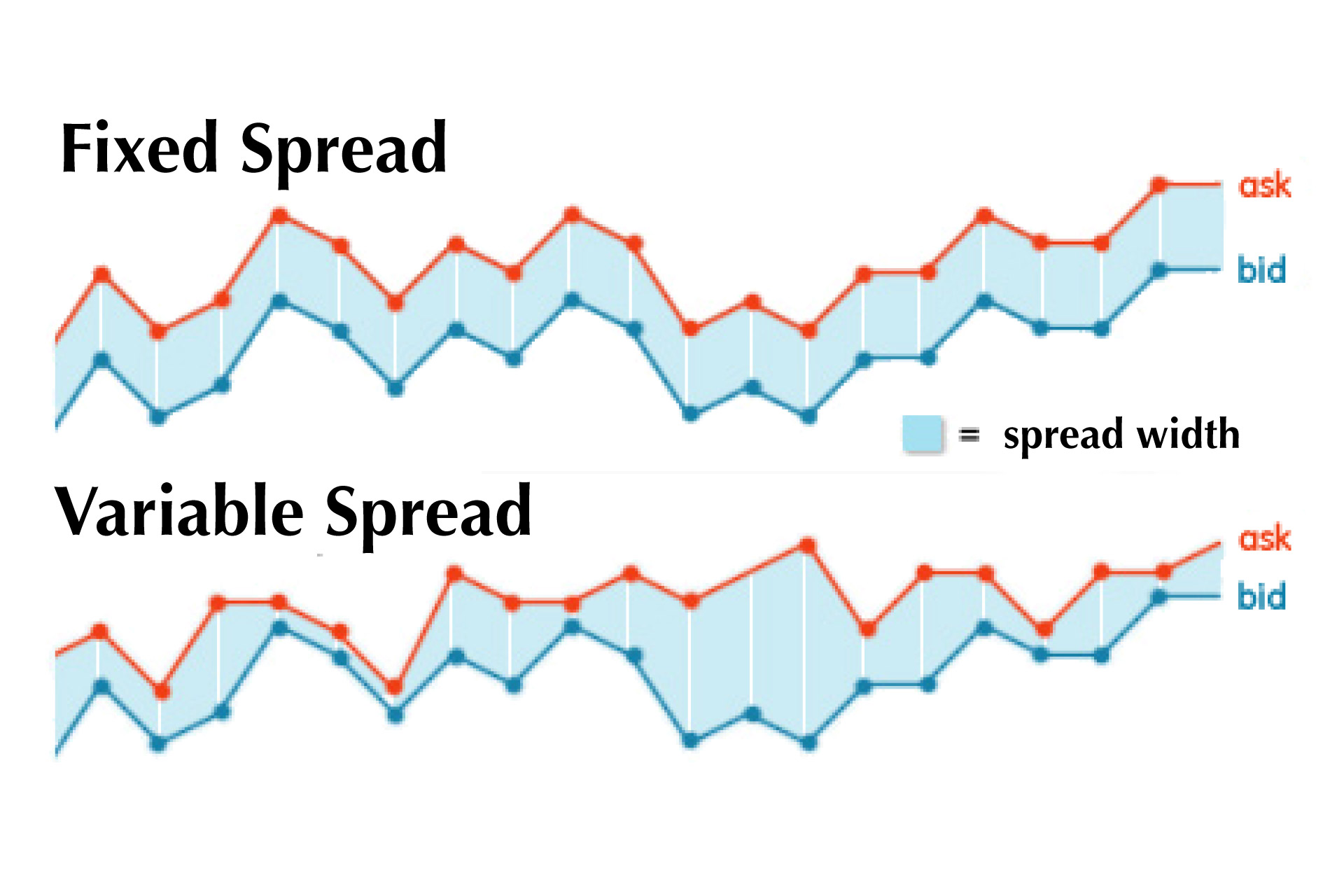

There are two types of spreads:

- Fixed

- Variable (also known as “floating”)

Fixed spreads are usually offered by brokers that operate as a market maker or “dealing desk” model while variable spreads are offered by brokers operating a “non-dealing desk” model.

What are Fixed Spreads in Forex?

Fixed spreads stay the same regardless of what market conditions are at any given time. In other words, whether the market is volatile like Kanye’s moods or quiet as a mouse, the spread is not affected. It stays the same.

Fixed spreads are offered by brokers that operate as a market maker or “dealing desk” model.

Using a dealing desk, the broker buys large positions from their liquidity provider(s) and offers these positions in smaller sizes to traders.

This means that the broker acts as the counterparty to their clients’ trades.

By having a dealing desk, this allows the forex broker to offer fixed spreads because they are able to control the prices they display to their clients.

What are the Advantages of Trading With Fixed Spreads?

Fixed spreads have smaller capital requirements, so trading with fixed spreads offer a cheaper alternative for traders who don’t have a lot of money to start trading with.

Trading with fixed spreads also makes calculating transaction costs more predictable. Since spreads never change, you’re always sure of what you can expect to pay when you open a trade.

What are the Disadvantages of Trading With Fixed Spreads?

Requotes can occur frequently when trading with fixed spreads since pricing is coming from just one source (your broker).

And by frequently, we mean almost as frequently as Instagram posts from Kardashian sisters!

There will be times when the forex market is volatile and prices are rapidly changing. Since spreads are fixed, the broker won’t be able to widen the spread to adjust for current market conditions.

So if you try to enter a trade at a specific price, the broker will “block” the trade and ask you to accept a new price. You will be “re-quoted” with a new price.

The requote message will appear on your trading platform letting you know that price has moved and asks you whether or not you are willing to accept that price. It’s almost always a price that is worse than the one you ordered.

Slippage is another problem. When prices are moving fast, the broker is unable to consistently maintain a fixed spread and the price that you finally end up after entering a trade will be totally different than the intended entry price.

Slippage is similar to when you swipe right on Tinder and agree to meet up with that hot gal or guy for coffee and realize the actual person in front of you looks nothing like the photo.

What are Variable Spreads in Forex?

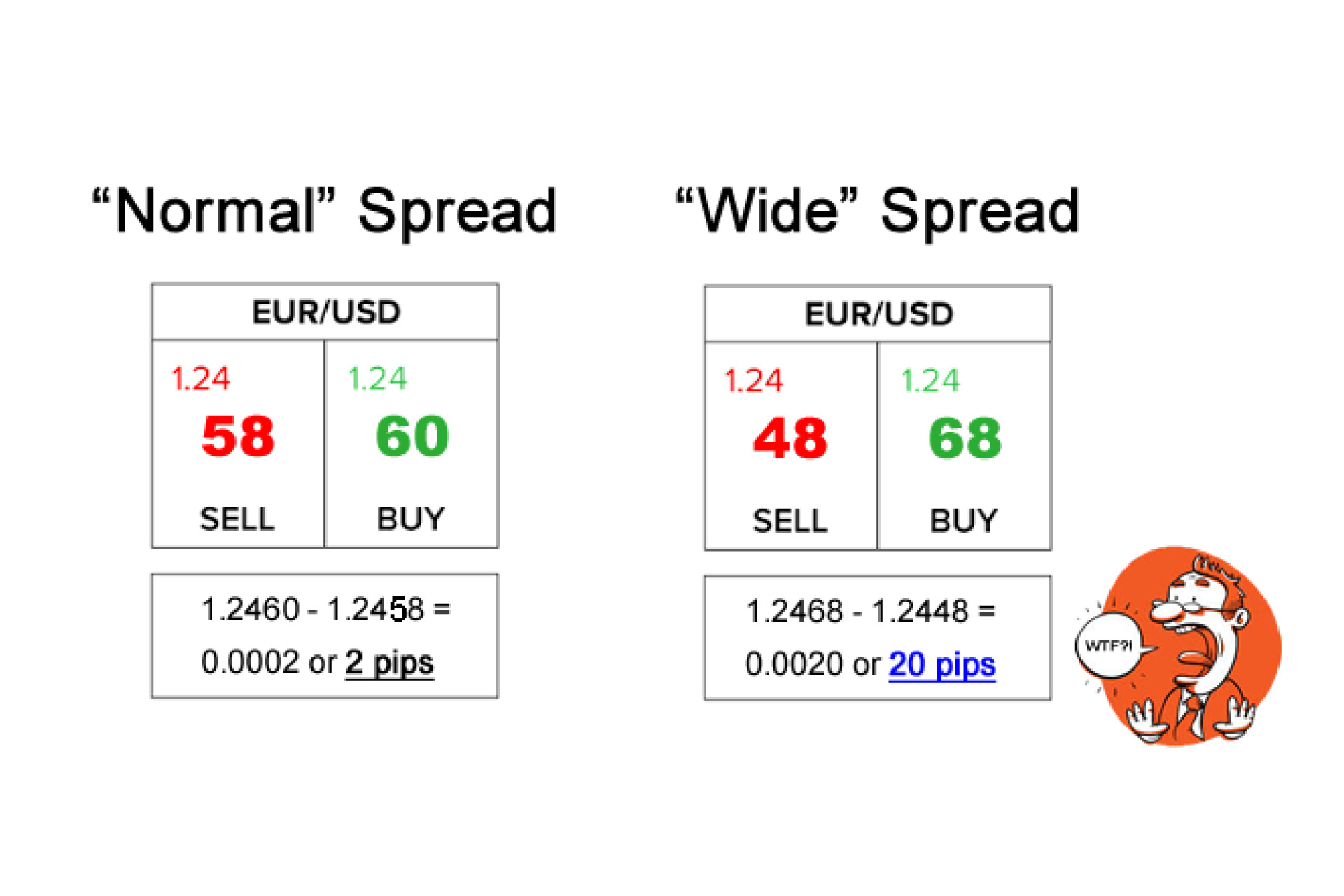

As the name suggests, variable spreads are always changing. With variable spreads, the difference between the bid and ask prices of currency pairs are constantly changing.

Variable spreads are offered by non-dealing desk brokers. Non-dealing desk brokers get their pricing of currency pairs from multiple liquidity providers and pass on these prices to the trader without the intervention of a dealing desk.

This means they have no control over the spreads. And spreads will widen or tighten based on the supply and demand of currencies and the overall market volatility.

Typically, spreads widen during economic data releases as well as other periods when the liquidity in the market decreases (like during holidays and when the zombie apocalypse begins).

For example, you may want to buy EURUSD with a spread of 2 pips, but just when you’re about to click buy, the U.S. unemployment report is released and the spread rapidly widens to 20 pips!

Oh, and spreads may also widen when Trump randomly tweets about the U.S. dollar.

What are the Advantages of Trading With Variable Spreads?

Variable spreads eliminate experiencing requotes. This is because the variation in the spread factors in changes in price due to market conditions.

(But just because you won’t get requoted doesn’t mean you won’t experience slippage.)

Trading forex with variable spreads also provides more transparent pricing, especially when you consider that having access to prices from multiple liquidity providers usually means better pricing due to competition.

What are the Disadvantages of Trading With Variable Spreads?

Variable spreads aren’t ideal for scalpers. The widened spreads can quickly eat into any profits that the scalper makes.

Variable spreads are just as bad for news traders. Spread may widen so much that what looks like a profitable can turn into an unprofitable within a blink of an eye.

Fixed vs Variable Spreads: Which is Better?

The question of which is a better option between fixed and variable spreads depends on the need of the trader.

There are traders who may find fixed spreads better than using variable spread brokers. The reverse may also be true for other traders.

Generally speaking, traders with smaller accounts and who trade less frequently will benefit from fixed spread pricing.

And traders with larger accounts who trade frequently during peak market hours (when spreads are the tightest) will benefit from variable spreads.

Traders who want fast trade execution and need to avoid requotes will want to trade with variable spreads.

Spread Costs and Calculations

Now that you know what a spread is, and the two different types of spreads, you need to know one more thing…

How the spread relates to actual transaction costs.

It’s pretty easy to calculate and all you need are two things:

- The value per pip

- The number of lots you’re trading

Let’s look at an example…

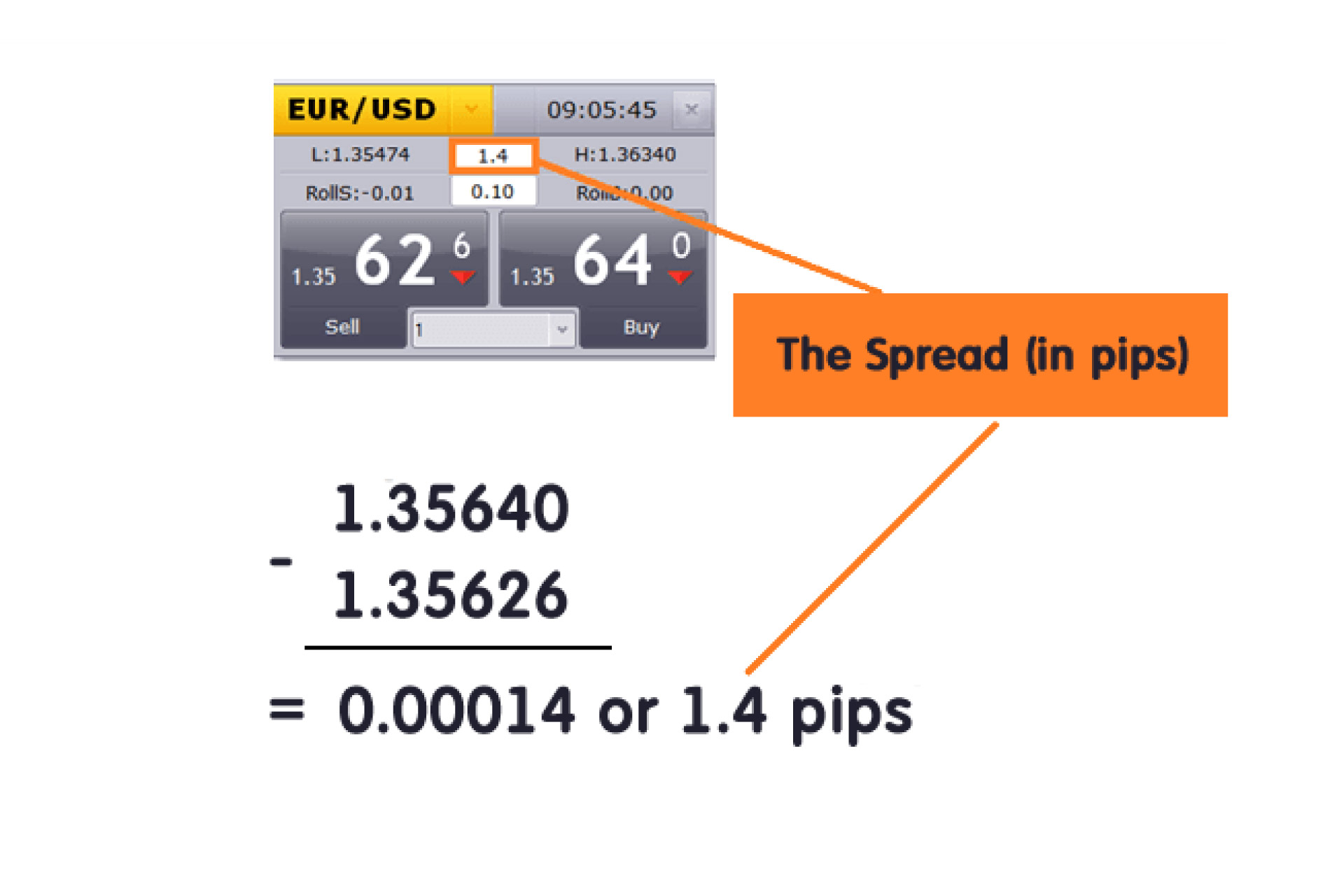

In the quote above, you can buy EURUSD at 1.35640 and sell EURUSD at 1.35626.

This means if you were to buy EURUSD and then immediately close it, it would result in a loss of 1.4 pips.

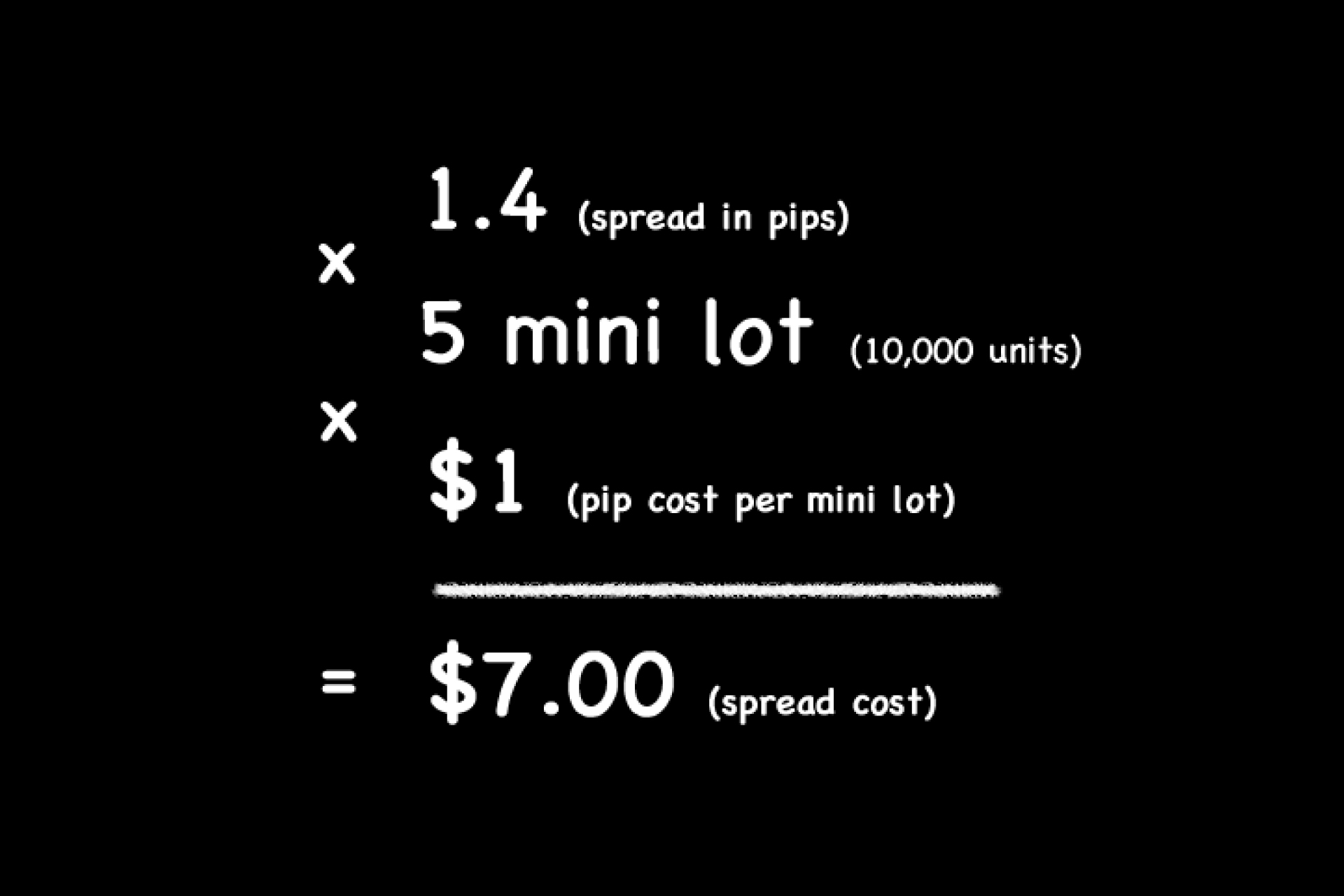

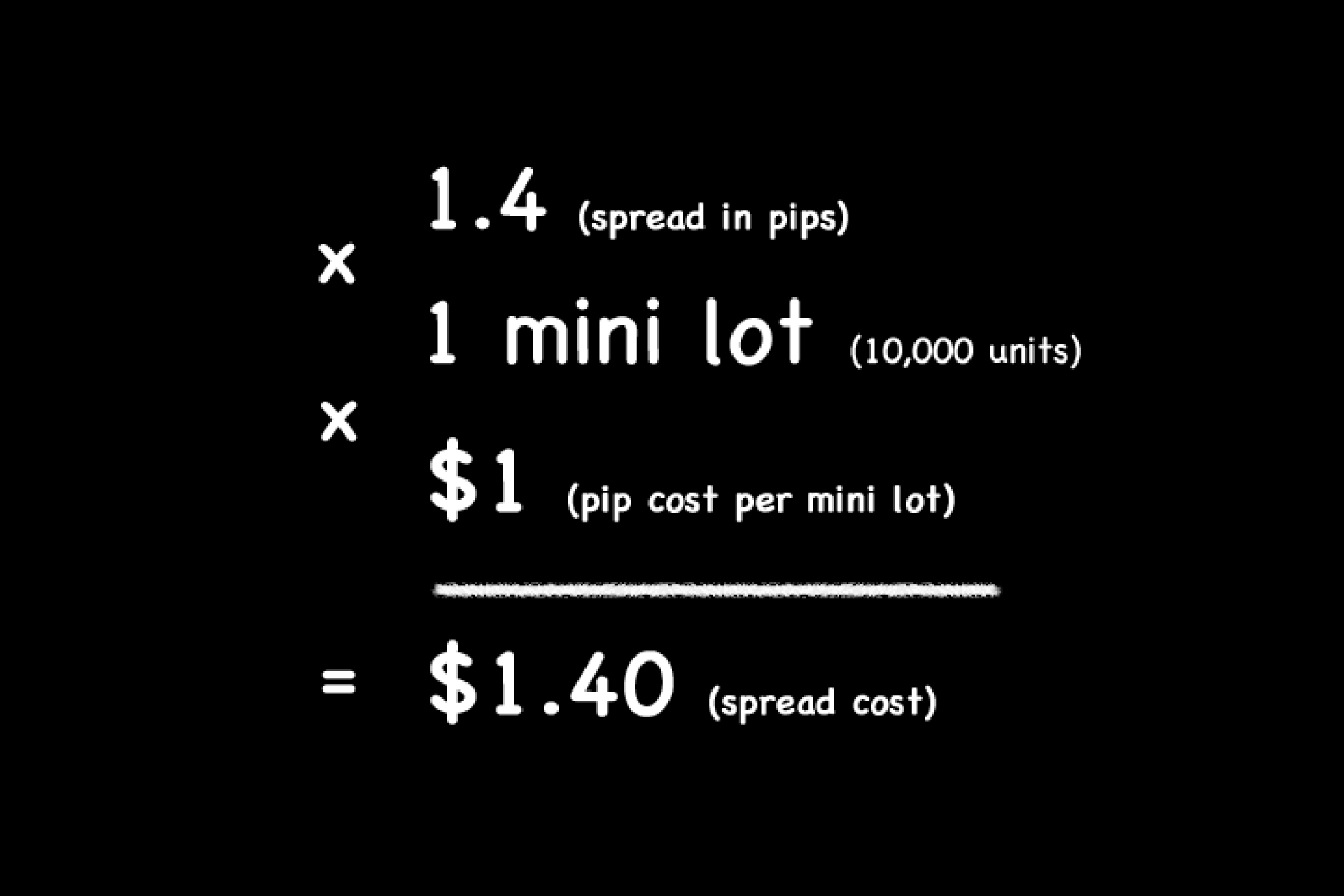

To figure out the total cost, you would multiply the cost per pip by the number of lots you’re trading.

So if you’re trading mini lots (10,000 units), the value per pip is $1, so your transaction cost would be $1.40 to open this trade.

The pip cost is linear. This means that you will need to multiply the cost per pip by the number of lots you are trading.

If you increase your position size, your transaction cost, which is reflected in the spread, will rise as well.

For example, if the spread is 1.4 pips and you’re trading 5 mini lots, then your transaction cost is $7.00.