As you can see, we have all the components of a good forex trading system.

First, we’ve decided that this is a swing trading system and that we will trade on a daily chart.

Next, we use simple moving averages to help us identify a new trend as early as possible.

The Stochastic help us determine if it’s still ok for us to enter a trade after a moving average crossover, and it also helps us avoid oversold and overbought areas.

The RSI is an extra confirmation tool that helps us determine the strength of our trend.

After figuring out our trade setup, we then determined our risk for each trade.

For this system, we are willing to risk 100 pips on each trade.

Usually, the higher the time frame, the more pips you should be willing to risk because your gains will typically be larger than if you were to trade on a smaller time frame.

Next, we clearly define our entry and exit rules.

At this point, we would begin the testing phase by starting with manual backtests.

If we went back in time and looked at this chart, we would see that according to our system rules, this would be a good time to go long.

To backtest, you would write down at what price you would’ve entered, your stop loss, and your exit strategy.

Then you would move the chart one candle at a time to see how the trade unfolds.

In this particular case, you would’ve made some decent pips! You could’ve bought yourself something nice after this trade!

You can see that when the moving averages cross in the opposite direction, it was a good time for us to exit.

Of course, not all your trades will look this sexy. Some will look like ugly heifers, but you should always remember to stay disciplined and stick to your trading system rules.

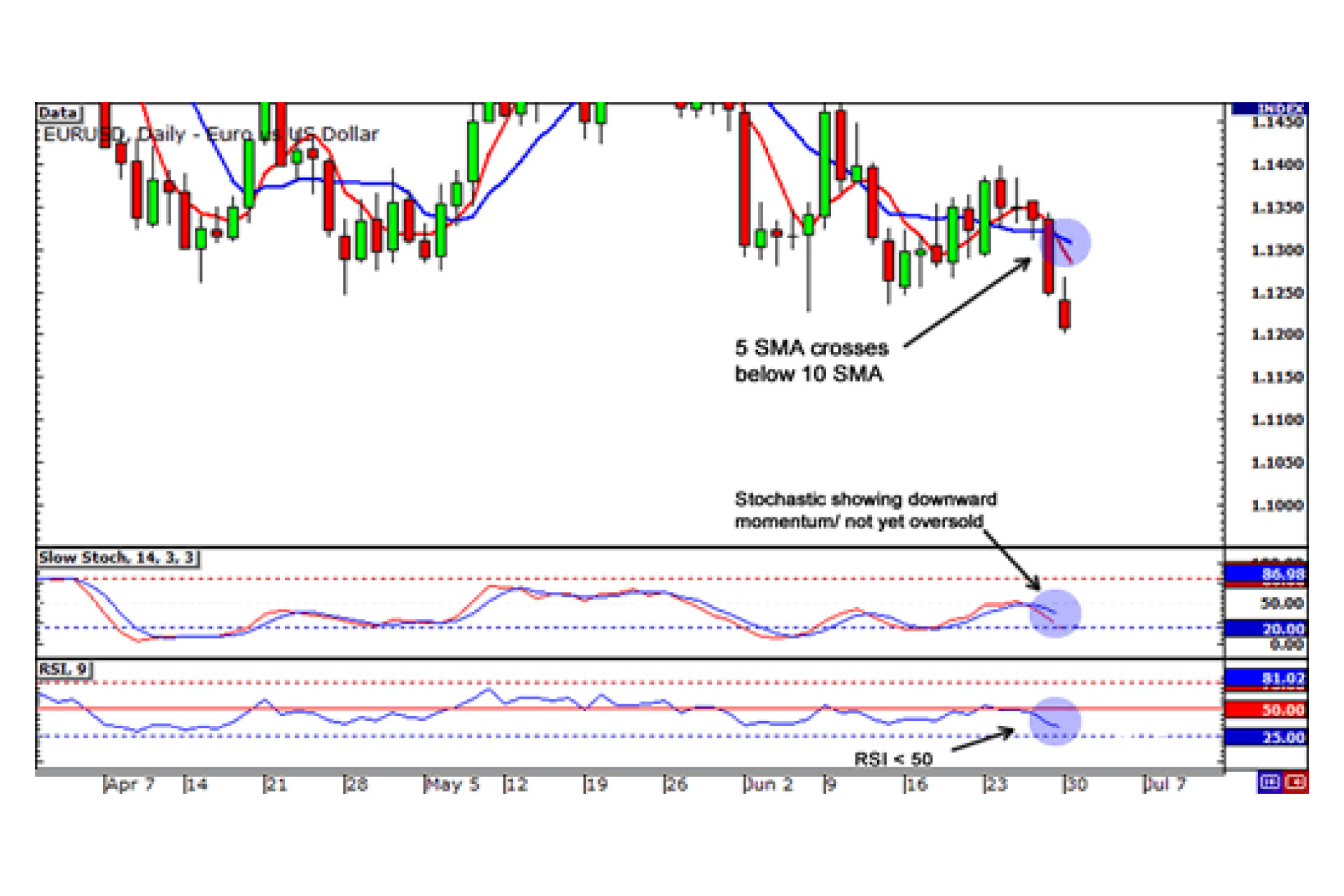

Trade Example: Sell EUR/USD

Here’s an example of a short entry order for the “So Easy It’s Ridiculous” system.

We can see that our criteria are met, as there was a moving average crossover, the Stochastic was showing downward momentum and not yet in oversold territory, and RSI was less than 50.

At this point, we would enter short.

Now we would record our entry price, our stop loss, and exit strategy, and then move the chart forward one candle at a time to see what happens.

Boo yeah baby! As it turns out, the trend was pretty strong and the pair dropped almost 800 pips before another crossover was made!

Now isn’t that ridiculously easy?

We know you’re probably thinking that this system is too simple to be profitable. Well, the truth is that it is simple. You shouldn’t be scared of something that’s simple.

In fact, there is an acronym that you will often see in the trading world called KISS.

It stands for Keep It Simple Stupid!

It basically means that forex trading systems don’t have to be complicated.

You don’t have to have a zillion indicators on your chart. In fact, keeping it simple will give you less of a headache.

The most important thing is discipline. We can’t stress it enough. Well, yes we can.

YOU MUST ALWAYS STICK TO YOUR TRADING SYSTEM RULES!

If you have tested your forex system thoroughly through backtesting and by trading it live on a DEMO account for at least a month (or two).

Then you should feel confident enough to know that as long as you follow your rules, you will end up profitable in the long run.

Trust your system and trust yourself!

If you want to see some examples of some slightly more complicated forex trading systems, take a look at Huck’s HLHB system or Pip Surfer’s Cowabunga system.