Did you know that the five deadliest factors that cause traders to fail are self-inflicted?

Many traders self-sabotage their own trading and may not even be aware they’re doing it. When their account goes to zero, they have nobody to blame but themselves.

While it might be too late for these traders, fortunately, it’s not too late for you.

We want to make sure that you don’t suffer from the same blind spots and can, hopefully, avoid sharing the same fate of a blown account.

To make it easier to remember, we call these negative factors, the “O’s of Trading“, and there are five of them.

There’s even a keto-friendly cereal inspired by the O’s.

A lot of traders have eaten this metaphorical cereal. Even vegan traders. While it looks delicious, if you want to increase your chances of success as a trader, you should definitely avoid eating this as part of your trader diet.

What are the 5 “O’s”?

- Overconfidence

- Overtrading

- Overleveraging

- Overexposure

- Overriding Stop Losses

Let’s take a look at each “O” more closely.

Overconfidence

Overconfidence isn’t simply the feeling that you can handle anything. Overconfidence is characterized by an inflated belief in one’s own trading skills.

Confidence is critical in becoming a successful trader. When you’re confident, you’re more likely to take risks or look for opportunities.

However, it’s one thing to believe that your trades can potentially be profitable, but it’s another thing to think that you know everything about the markets and that there’s no way for you to ever lose because all you do is win. You are not DJ Khaled.

While confidence is necessary, too much confidence can have negative consequences.

This phenomenon is known as the overconfidence effect.

The overconfidence effect is a cognitive bias in which someone believes subjectively that his or her judgment is better or more reliable than it objectively is.

Basically, when your confidence is high, your opinion of yourself is higher than what an impartial and rational person (who is not your mom) would think about you given the same set of facts.

Psychologists observe overconfidence in three distinct forms:

- Overestimation

- Overprecision

- Overplacement

Overestimation is the tendency to overestimate one’s performance.

Overprecision is the excessive confidence that one knows the truth.

Overplacement is a judgment of your performance compared to another.

Said differently, overconfident folks believe they’re better than most and overestimate the precision of their knowledge and the level of their abilities.

For example, if you ask a bunch of random people to rate their own driving abilities, you’ll find that most people consider themselves to be above average drivers!

If everyone is an above-average driver, where are the average drivers?

To minimize the effects of the overconfidence effect, you must take time to truly understand yourself and what you are capable of achieving.

You must be aware of your limitations and what opportunities are not worth pursuing.

Most importantly, you must ALWAYS consider the possibility that you are WRONG, to listen to new evidence, and to know when to change your mind!

You must have the confidence to trade, but this must be balanced with intellectual humility.

Overtrading (including Revenge Trading)

Overtading is when you are trading too frequently, taking extremely large trades, and/or taking uncalculated risks.

Successful traders are extremely patient. Quality setups take time to materialize, so they remain patient and wait for confirmation.

It doesn’t matter if the setup takes two hours or two weeks to take shape.

What matters is protecting their capital so they will wait until the odds are more in their favor before entering.

You will know if you are overtrading.

If you close a trade for a loss and deep down, you feel like you shouldn’t have taken the trade, then you’re GUILTY of overtrading.

For example, when you’re supposed to trade from the daily chart, do you find yourself still looking at the lower time frames like the 5-minute chart and “discovering” better trades there?

Do you find yourself spending hours staring at charts and trying to “force” a trade with a “good enough” setup?

Spending too much time staring at charts tends to cause overtrading because you become prone to falling into a trance looking at so much “price action” (and indicators) that magical setups will just start appearing, which are actually just MIRAGES!

Revenge Trading

Letting your emotions get to you regarding your trading performances is dangerous.

When it comes to trading, the head, not the heart, should be in charge.

When you suffer a large loss, or a series of losses, within a short span of time, you might be tempted to “revenge trade”.

You want to “get back at the market”.

Revenge trading is when you jump back into a new trade right after taking a loss because you believe that you can quickly flip the loss back into a profit.

When you start thinking like this, your state of mind is not objective anymore. You become more prone to making even more trading mistakes, which results in you losing even more money.

How do you avoid revenge trading?

- Be fully present and fully focused while trading.

- Make sure you’re in a good state of mind and not currently filled with negative emotions such as anxiety, apathy, fear, greed or impatience.

- Have a trading plan and stick to it! Always trade in a methodical manner. There is no place for random improvisation when you enter or are in a trade.

If you want to succeed as a trader, you must think long term.

Don’t stress over one loss or even losing a couple days in a row. Stay focused on your trading performance over the coming months and years.

It’s easy to think that the more you trade, the more money you’ll make. But the opposite is true.

Trading is a game of patience. Traders who wait for quality setups and sit on their hands in between are the ones who will end up profitable in the long run. Focus on the process. Not on the profits.

Overleveraging

In forex trading, leverage means that with a small amount of capital in your account, you can open and control a much larger trading position.

For example, with a $1,000, your broker might allow you to open a $100,000 position. This is 100:1 leverage.

The advantage of using leverage is you can magnify gains with a limited amount of capital.

The disadvantage of leverage is that you can also magnify your losses and quickly blow your account!

When trading with excessive leverage, a small price swing can wipe out your entire account balance.

The greater the leverage level you use, the greater the swings in your account equity. In most cases, you end up with a margin call.

When your account equity is jumping around due to your highly levered positions, good luck keeping your emotions in check and not letting it affect your thinking.

Nobody will want to be around you when this is happening.

When trading with low (or no) leverage, you will give your trade “room to breathe” and protect your trading capital.

For example, you’ll be able to accommodate wider stop losses while keeping your risk limited.

The higher your leverage, the greater your risk on each trade, likely resulting in irrational decision making.

Knowing the link between leverage and your account equity is crucial since it determines your true leverage.

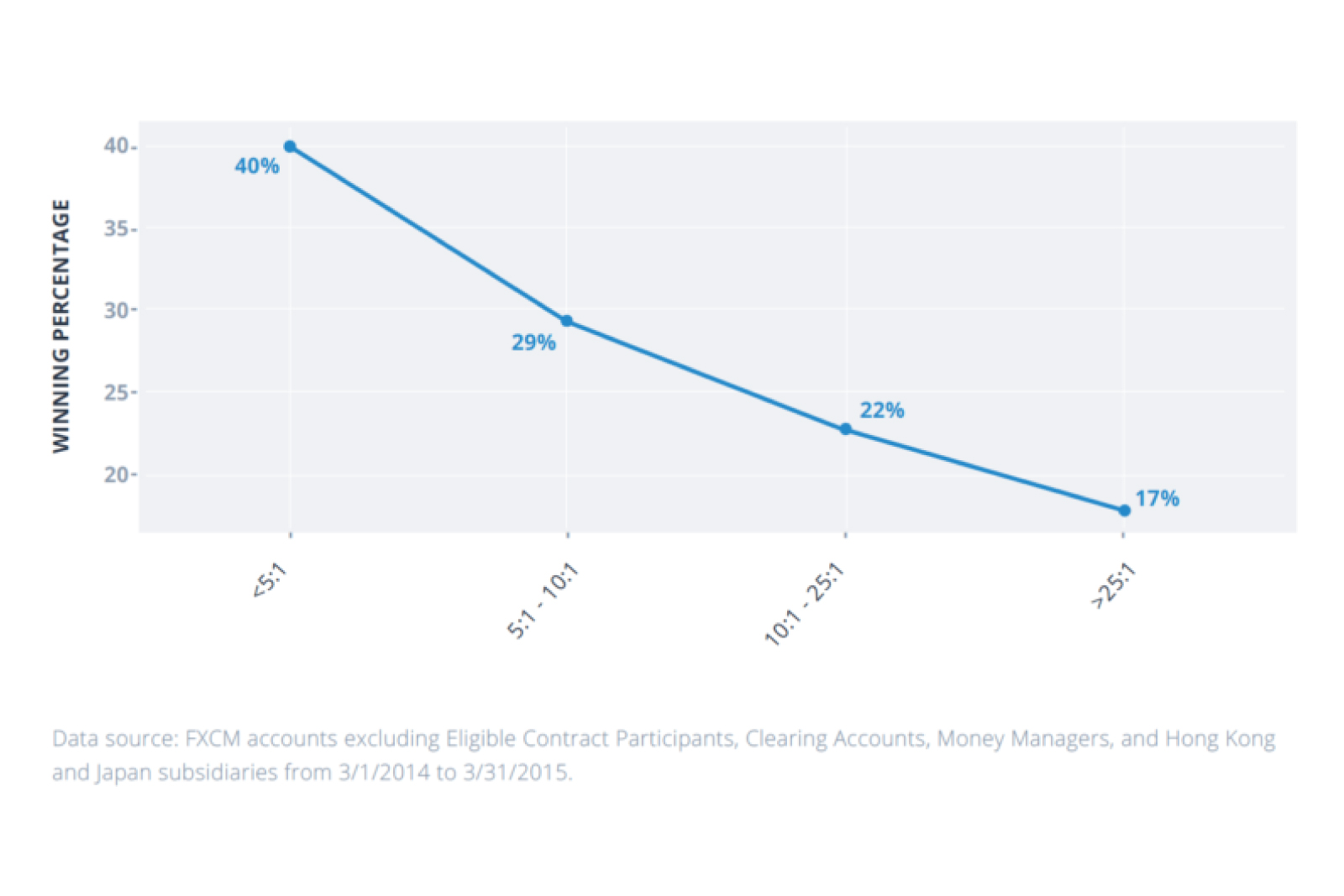

Here’s a study that was done by a popular forex broker showing the percentage of profitable traders by average true leverage.

As you can see, profitability declines substantially as true leverage increases!

40% of traders using true leverage of 5:1 or lower were profitable, compared to only 17% of traders using 25:1 leverage or higher.

Most professional traders trade with very low true leverage and rarely go above 10:1. That’s how they stay in the game.

Regardless of the leverage amount that your broker offers, you can emulate these lower leverage levels by simply depositing more money in your account and managing your risk properly like using proper position sizing.

Use true leverage of 10:1 or lower.

Only risk 10% or less of your account balance at any given time. Never let the value of all your trades open exceed 10 times your account equity.

To calculate your true leverage of a single trade, divide your trade size by your account equity.

For example, if you open an account with $5,000 in equity, a 10:1 leverage would mean opening positions no larger than $50,000 (or ~5 mini or 50 micro lots) at a time.

The lower the leverage, the safer. For example, a 2:1 leverage would mean opening positions no larger than $10,000 (or ~10 micro lots) at a time.

If you care about longevity as a trader, the LESS leverage you use, the better.

Having access to high leverage doesn’t mean you need to use it!

When you first open your live account, try to start trading with ZERO leverage.

For example, if you have $5,000 in your trading account, don’t open any positions larger than $5,000 (or ~5 micro lots) at a time.

With experience, you’ll learn when it’s best to use leverage, and how much leverage to apply, to help you achieve your financial goals.

When using any amount of leverage, trading with CAUTION should be your priority.

Excessive leverage makes profitability significantly less likely.

What exactly is leverage and how does it work? Learn more about leverage before you blow your accout.

Overexposure

When you have multiple positions open in your trading account and each position consist of a different currency pair, always make sure you’re aware of your RISK EXPOSURE.

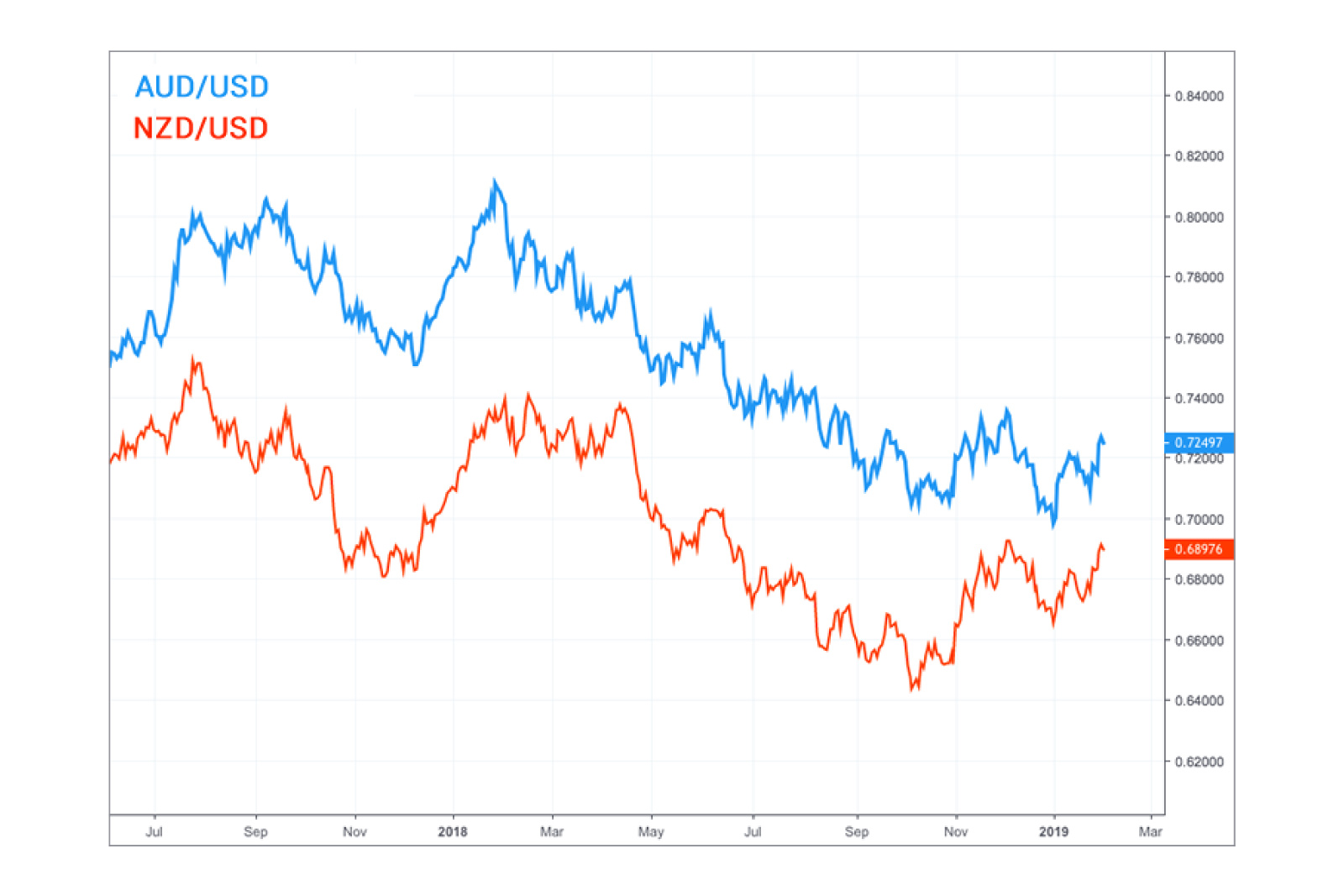

For example, on most occasions, trading AUD/USD and NZD/USD is essentially like having two identical trades open because they usually move in a similar manner.

Even if there are two valid trade setups in both pairs, you may not want to take both.

Instead, it might make more sense to pick ONE out of the two setups.

You might believe that you’re spreading or diversifying your risk by trading in different pairs, but many pairs tend to move in the same direction.

So instead of reducing risk, you are magnifying your risk!

Unknowingly, you are actually exposing yourself to MORE risk.

This is known as overexposure.

Unless you plan on trading just one pair at a time, it’s crucial that you understand how different currency pairs move in relation to each other.

You need to understand the concept of currency correlation.

Currency correlation measures how two currency pairs move in the same, opposite, or totally random direction, over some period of time.

You need to be familiar with how currency correlations can affect the amount of risk you’re exposing your trading account to.

If you don’t know what the heck you’re doing when trading multiple pairs simultaneously in your trading account, don’t be surprised if your account balance goes poof!

Are you doubling or tripling your risk without knowing it? Learn more about currency correlation.

Overriding Stops

Stop losses are pending orders you enter that effectively close out your trading position(s) when losses hit a predetermined price.

It might be psychologically difficult for you to acknowledge being wrong, but swallowing your pride can keep you in the game longer.

Do you have the mental toughness and self-control to stick to your stops?

In the heat of battle, what often separates the long-term winners from the losers is whether or not they can objectively follow their predetermined plans.

Traders, especially the more inexperienced ones, often question themselves and lose that objectivity when the pain of losing kicks in.

Negative thoughts appear such as, “I’m already down a lot. Might as well hold on. Maybe the market will turn right here.”

Wrong!

If the market has reached your stop, your reason for the trade is no longer valid and it’s time to close it out.

Do not widen your stop.

Even worse, do not override or remove your stop and “Let it ride!”

Increasing your stop only increases your risk and the amount you will LOSE!

If the market hits your planned stop then your trade is done.

Take the hit and move on to the next opportunity.

Widening your stop is basically like not having a stop at all and it doesn’t make any sense to do it!

Stop losses help you limit your losses and help you move on. Learn about the different types of stop losses and how to properly use them.