The previous lesson discussed how to set stop loss using a percentage-based amount of your account.

A more sensible way to determine stops would be to base it on what the charts are saying.

Since we’re trading the markets, we might as well base our stops on what the markets are showing us… Makes sense, right?

One of the things that we can observe in price action is that there are times when prices can’t seem to push or break beyond certain levels.

Often times, when these areas of support or resistance are retested, they could potentially hold the market from pushing through once again.

Setting stops beyond these levels of support and resistance makes sense, because if the market does trade beyond these areas, then it is reasonable to think that a break of that area will bring in more traders to play the break and further push your position against you.

Or, if these levels DO break, then there may be forces that you are unaware of suddenly pushing the market one way or another.

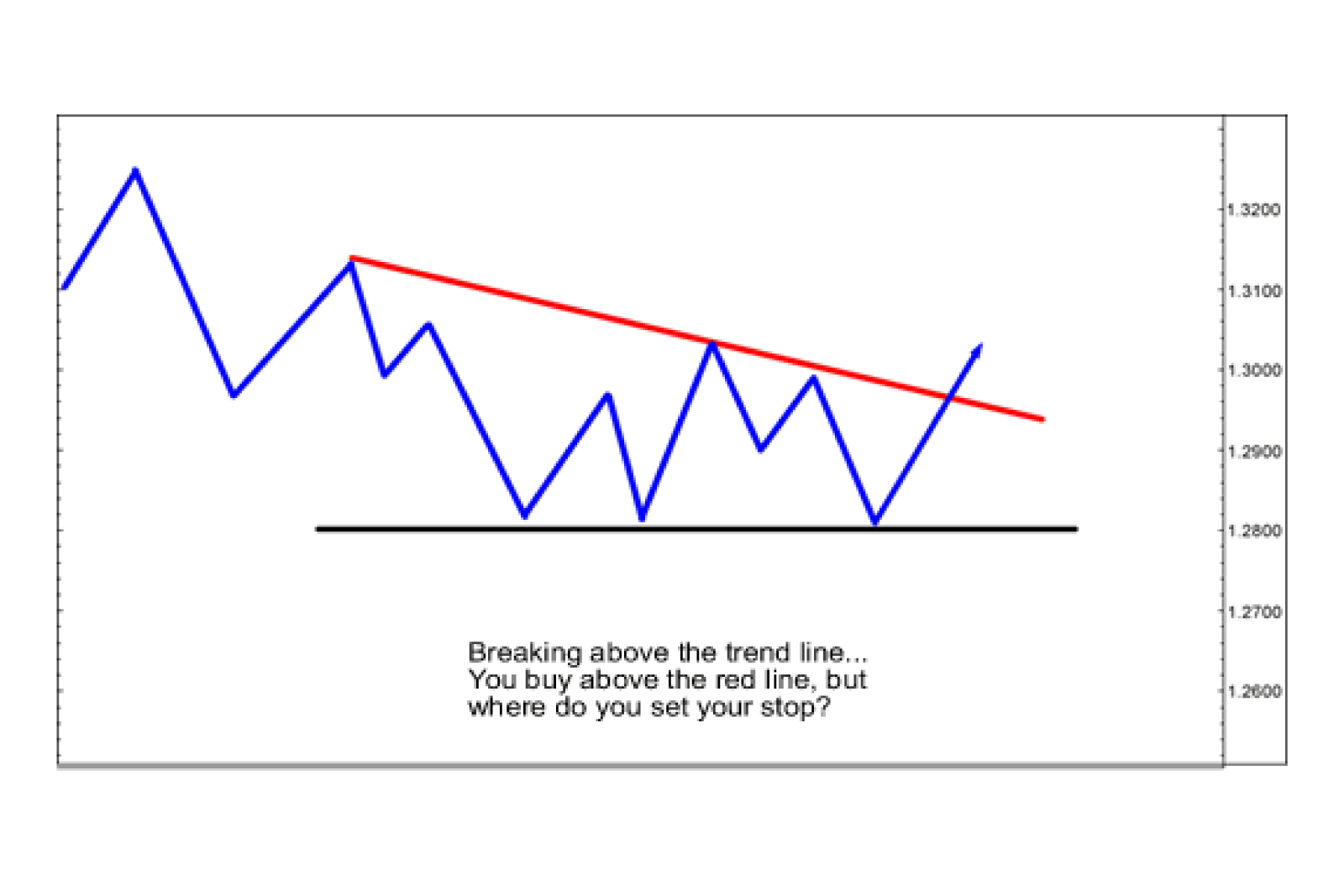

Let’s take a quick look at a way to set your stops based on support and resistance:

On the chart above, we can see that the pair is now trading above the falling trend line.

You decide that this is a great breakout trade setup and you decide to go long.

But before you enter your trade, ask yourself the following questions:

Where could you possibly set your stop?

What conditions would tell you when your original trade idea is invalidated?

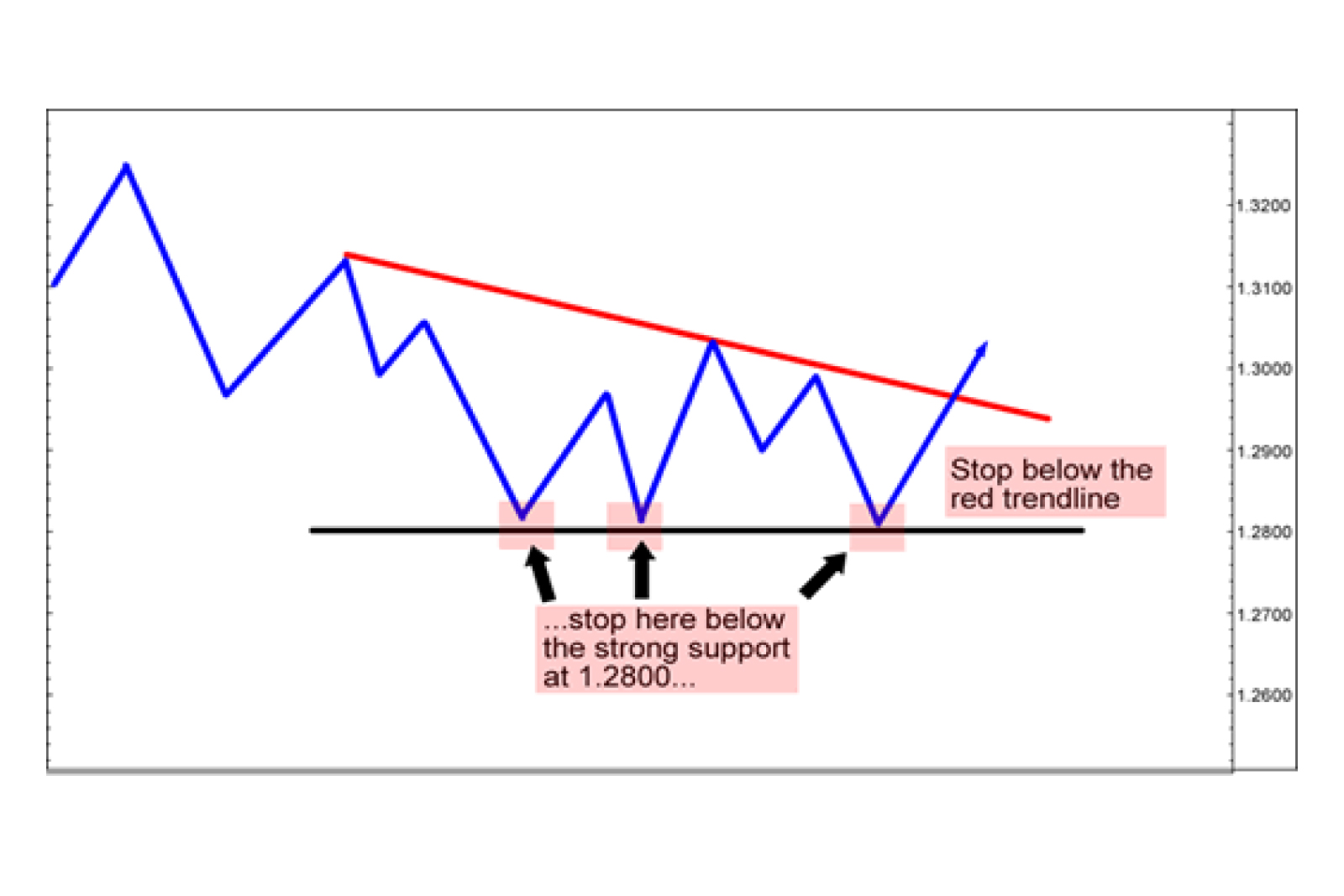

On the chart above, we can see that the pair is now trading above the falling trend line.

You decide that this is a great breakout trade setup and you decide to go long.

But before you enter your trade, ask yourself the following questions:

- Where could you possibly set your stop?

- What conditions would tell you when your original trade idea is invalidated?

In this case, it makes the most sense to set your stops below the trend lines and support areas.

If the market moves into these areas, that means the trend lines drew no support from buyers and now sellers are in control.

Your trade idea was invalidated and it’s time you to suck it up, exit the trade, and accept the loss.

Example: Short EUR/USD

In the chart below, the EUR/USD has been trending down. Price has hit the falling trendline a couple times which makes for a nice resistance level.

You could place a short order right at the downtrend line (1.3690).

Now, where you would you place your stop loss?

Your stop loss would be placed at 1.3800.

Notice how this is above the resistance area: the falling trendline.

Let’s set profit targets at 1.3530 and 1.3450.

The trade is triggered. The trendline holds as resistance and price falls.

Your first profit target is hit. The second profit target is missed by a single pip but by that time, you had moved your stop loss to breakeven (where you entered short) so you lost nothing.

This is an example of using resistance as a guide on where to place your stop instead of simply using a fixed number.