Let’s talk about the other kind of gold… the black one.

As you may know, crude oil is often referred to as the “black gold” or as we here at BabyPips.com like to call it, “black crack.”

One can live without gold, but if you’re a crack addict, you can’t live without crack.

Oil is the drug that runs through the veins of the global economy as it is a major source of energy.

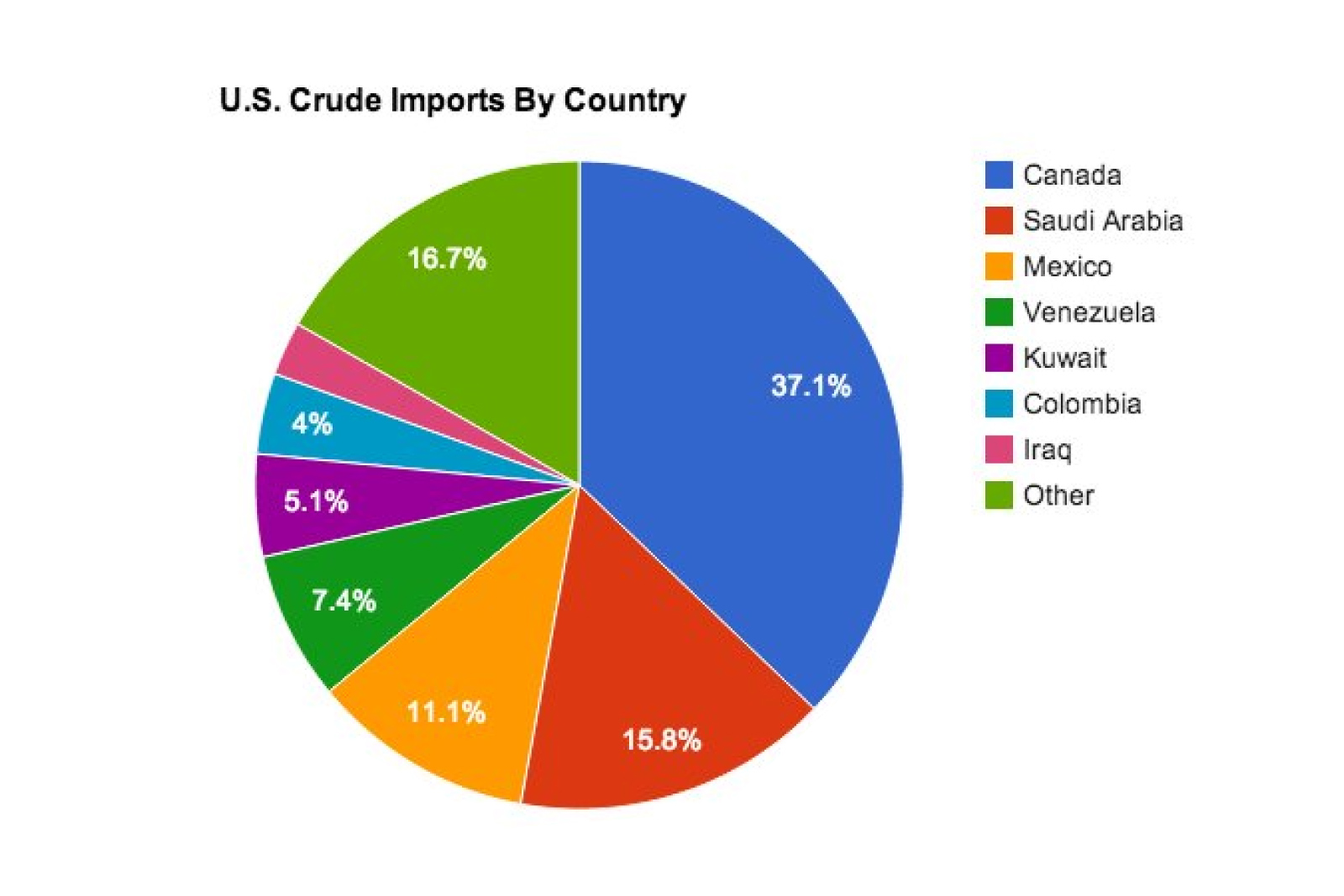

Canada, one of the top oil producers in the world, exports over 3 million barrels of oil and petroleum products per day to the United States.

This makes it the largest supplier of oil to the U.S.!

This means that Canada is United States’ main black crack dealer!

Because of the volume involved, it creates a huge amount of demand for Canadian dollars.

Also, take note that Canada’s economy is dependent on exports, with about 85% of its exports going to its big brother down south, the U.S.

Because of this, USD/CAD can be greatly affected by how U.S. consumers react to changes in oil prices.

If U.S. demand rises, manufacturers will need to order more oil to keep up with demand. This can lead to a rise in oil prices, which might lead to a fall in USD/CAD.

If U.S. demand falls, manufacturers may decide to chill out since they don’t need to make more goods. Demand for oil might fall, which could hurt demand for the CAD.

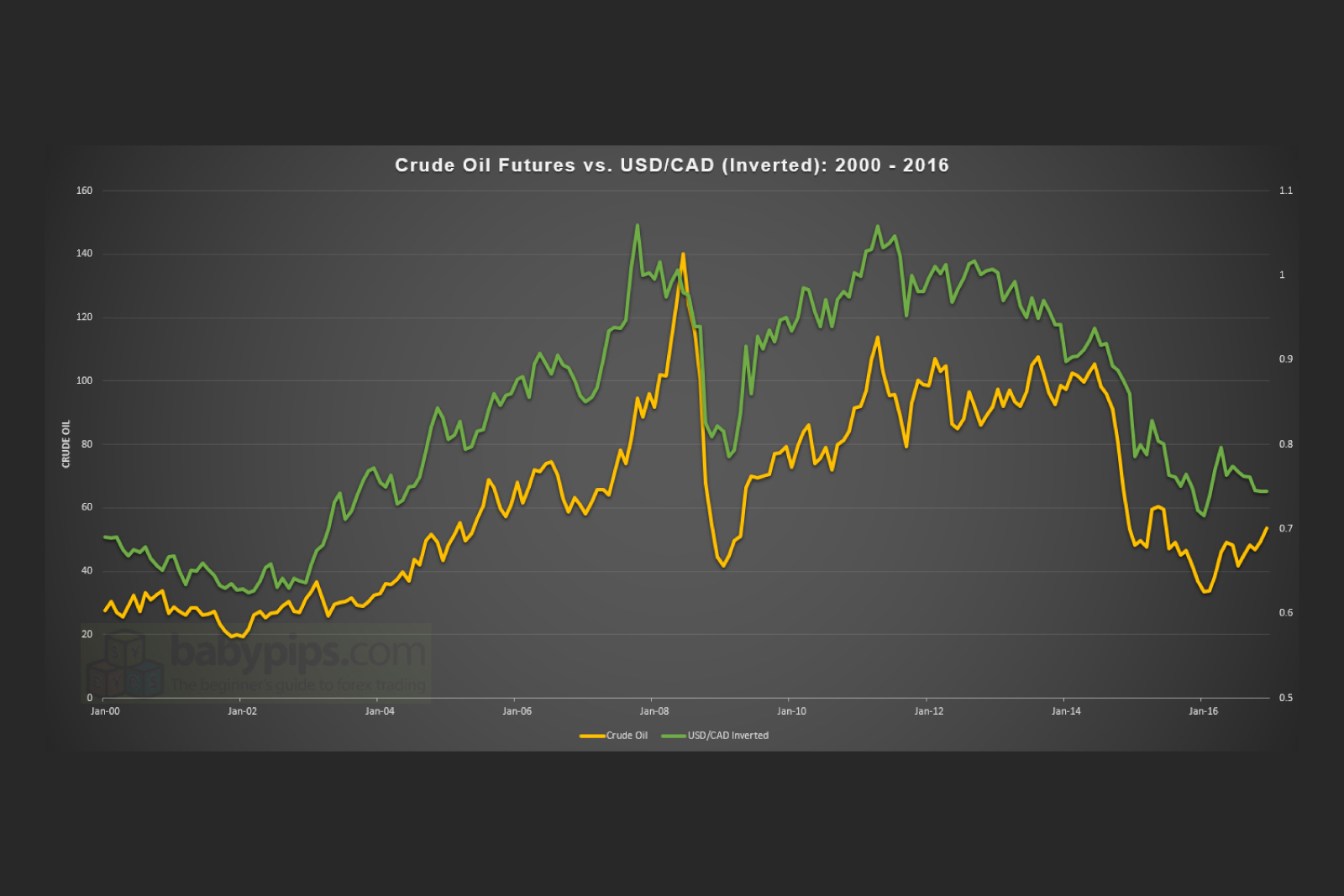

Oil has a negative correlation with USD/CAD of about 93% between 2000 through 2016.

When oil goes up, USD/CAD goes down. When oil goes down, USD/CAD goes up.

And to make the correlation clearer, we can invert USD/CAD to show how both markets move pretty much at the same time (i.e., crude oil will gain value with the Canadian dollar while the U.S. dollar falls…and vice versa. Check it out in the chart below:

Check it out in the chart below:

So, the next time you gas up your car and see that oil prices are rising, you can use this information to your advantage! It may be a clue for you to go short on USD/CAD!

Some forex brokers allow you to trade gold, oil, and other commodities. There, you can readily pull up their charts using their platforms.

You can also monitor the prices of gold on Bloomberg. You can likewise check the prices of oil on Bloomberg as well.

If you want to learn more about gold and other commodities, I suggest you ask our ComDoll expert Happy Pip.

Since she trades the commodity currencies, she often includes the price action of gold and oil in