A bond is an “IOU” issued by an entity when it needs to borrow money.

These entities, such as governments, municipalities, or multinational companies, need a lot of funds in order to operate so they often need to borrow from banks or individuals like you.

When you own a government bond, in effect, the government has borrowed money from you.

You might be wondering, “Isn’t that the same as owning stocks?”

One major difference is that bonds typically have a defined term to maturity, wherein the owner gets paid back the money he loaned, known as the principal, at a predetermined set date.

Also, when an investor purchases a bond from a company, he gets paid at a specified rate of return, also known as the bond yield, at certain time intervals.

These periodical interest payments are commonly known as coupon payments.

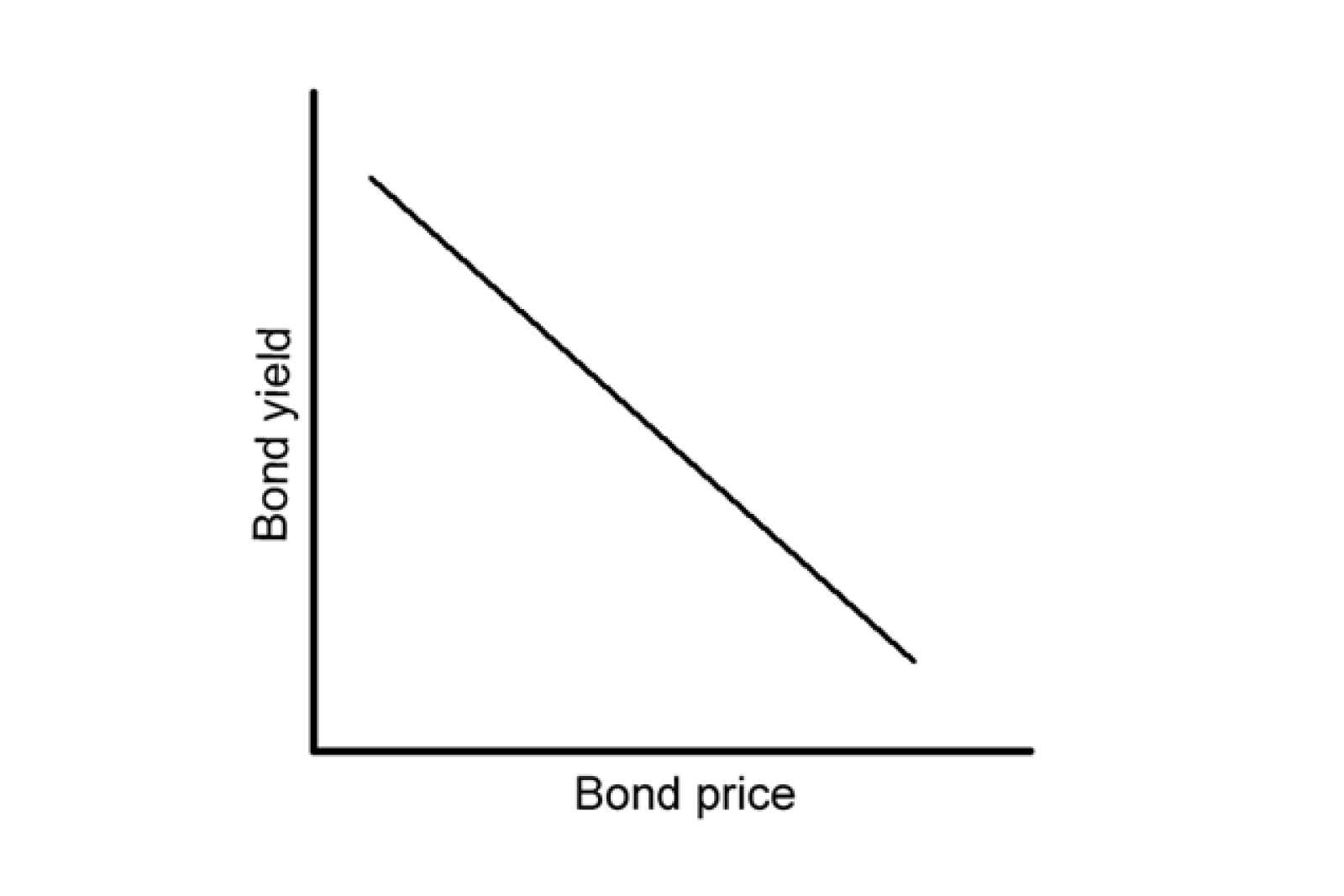

Bond yield refers to the rate of return or interest paid to the bondholder while the bond price is the amount of money the bondholder pays for the bond.

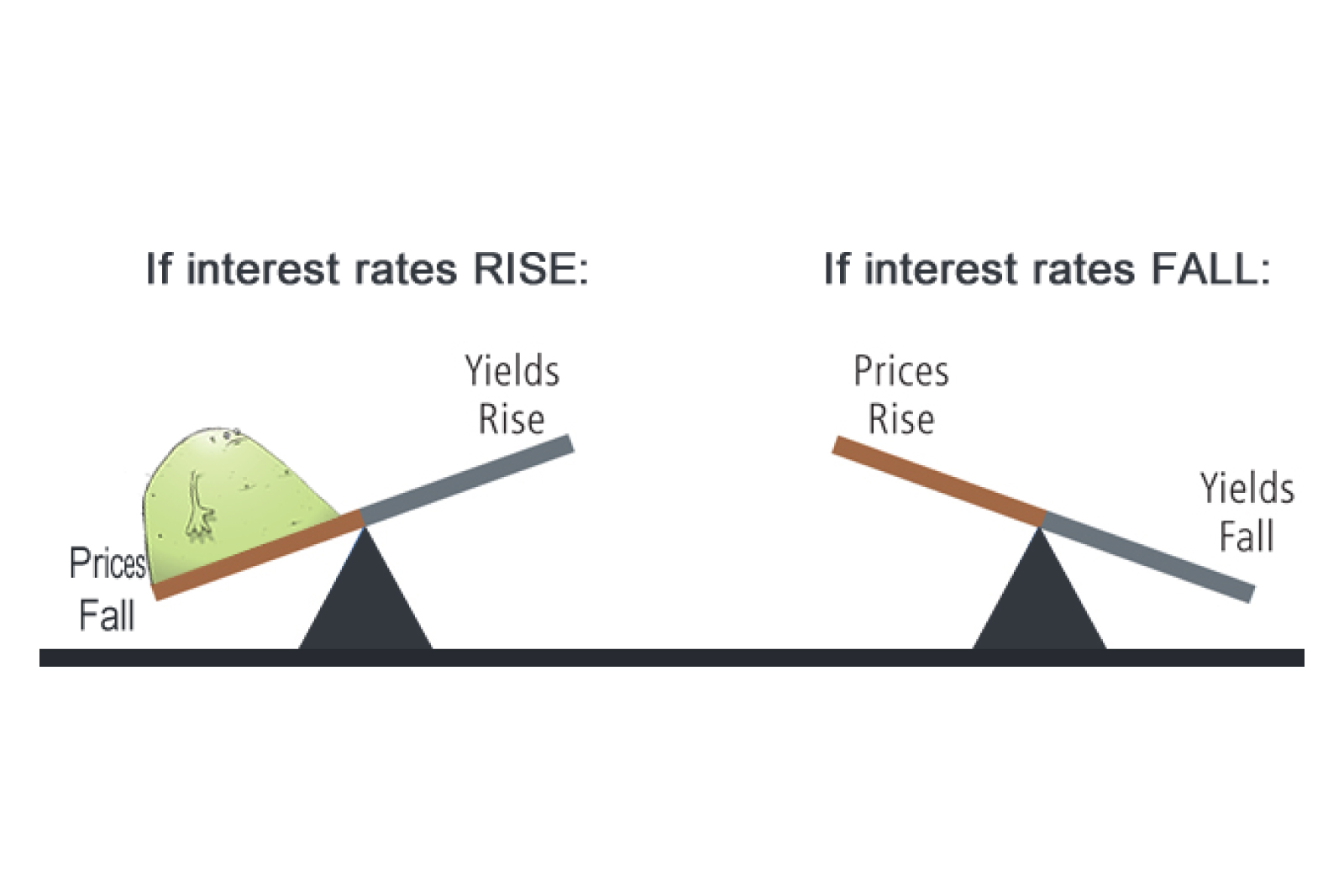

Now, bond prices and bond yields are inversely correlated. When bond prices rise, bond yields fall and vice-versa.

Here’s a simple illustration to help you remember:

Still confused? How about this one?

Wait a minute… What does this have to do with the currency market?!!

Let’s ignore that question for now.

Always keep in mind that inter-market relationships govern currency price action.

Bond yields actually serve as an excellent indicator of the strength of a nation’s stock market, which increases the demand for the nation’s currency.

For example, U.S. bond yields gauge the performance of the U.S. stock market, thereby reflecting the demand for the U.S. dollar.

Let’s look at one scenario: Demand for bonds usually increases when investors are concerned about the safety of their stock investments.

This flight to safety drives bond prices higher and, by virtue of their inverse relationship, pushes bond yields down.

As more and more investors move away from stocks and other high-risk investments, increased demand for “less-risky instruments” such as U.S. bonds and the safe-haven U.S. dollar pushes their prices higher.

Government bond yields act as an indicator of the overall direction of the country’s interest rates and expectations.

For example, in the U.S., you would focus on the 10-year Treasury note.

A rising yield is dollar bullish. A falling yield is dollar bearish.

It’s important to know the underlying dynamic of why a bond’s yield is rising or falling.

It can be based on interest rate expectations OR it can be based on market uncertainty and a “flight to safety” with capital flowing from risky assets like stocks to less risky assets like bonds.

After understanding how rising bond yields usually cause a nation’s currency to appreciate, you’re probably itching to find out how this can be applied to forex trading. Patience, young padawan!

Recall that one of our goals in forex trading (aside from catching plenty of pips!), is to pair up a strong currency with a weak one by first comparing their respective economies.

How can we use their bond yields to do that?