The first step in choosing a forex broker is finding out what your choices are.

You don’t just walk into a restaurant, knowing what to order right away, do you?

Not unless you’re a frequent customer there, of course. More often than not, you check out their menu first to see what they have to offer.

There are two main types of forex brokers:

- Dealing Desks (DD)

- No Dealing Desks (NDD).

Dealing Desk brokers are also called Market Makers.

No Dealing Desks can be further subdivided into:

- Straight Through Processing (STP) and

- Electronic Communication Network + Straight Through Processing (ECN+STP).

What is a Dealing Desk Broker?

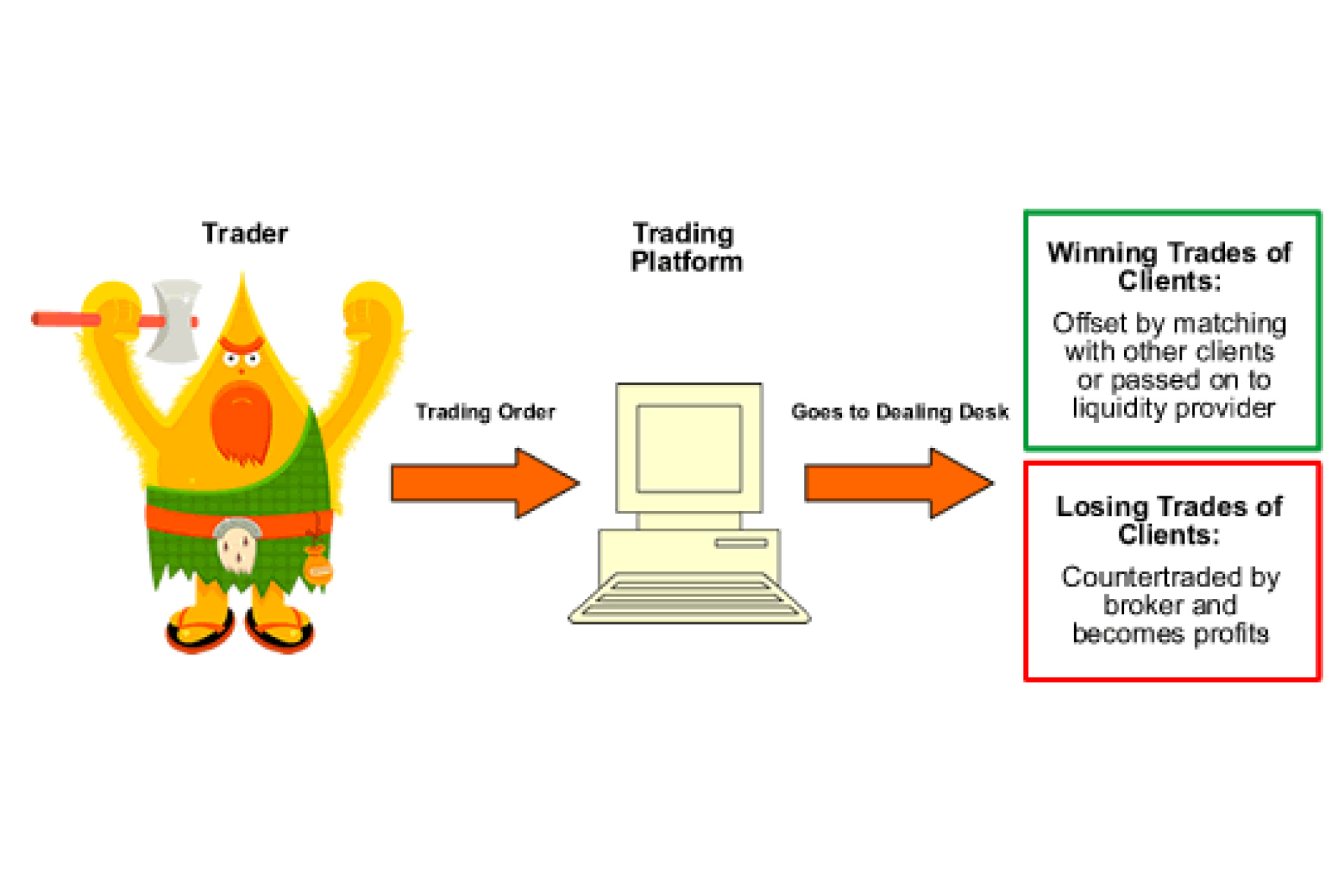

Forex brokers that operate through Dealing Desk (DD) brokers make money through spreads and providing liquidity to their clients. Also called “market makers.”

Dealing Desk brokers literally create a market for their clients, meaning they often take the other side of a clients trade.

While you may think that there is a conflict of interest, there really isn’t.

Market makers provide both a sell and buy quote, which means that they are filling both buy and sell orders of their clients; they are indifferent to the decisions of an individual trader.

Since market makers control the prices at which orders are filled, it also follows that there is very little risk for them to set FIXED spreads (you will understand why this is so much better later).

Also, clients of dealing desk brokers do not see the real interbank market rates. Don’t be scared though. The competition among brokers is so stiff that the rates offered by Dealing Desks brokers are close, if not the same, to the interbank rates.

Trading using a Dealing Desk broker basically works this way:

Let’s say you place a buy order for EUR/USD for 100,000 units with your Dealing Desk broker.

To fill you, your broker will first try to find a matching sell order from its other clients or pass your trades on to its liquidity provider, i.e. a sizable entity that readily buys or sells a financial asset.

By doing this, they minimize risk, as they earn from the spread without taking the opposite side of your trade.

However, in the event that there are no matching orders, they will have to take the opposite side of your trade.

Take note that different forex brokers have different risk management policies, so make sure to check with your own broker regarding this.

What is a No Dealing Desk Broker?

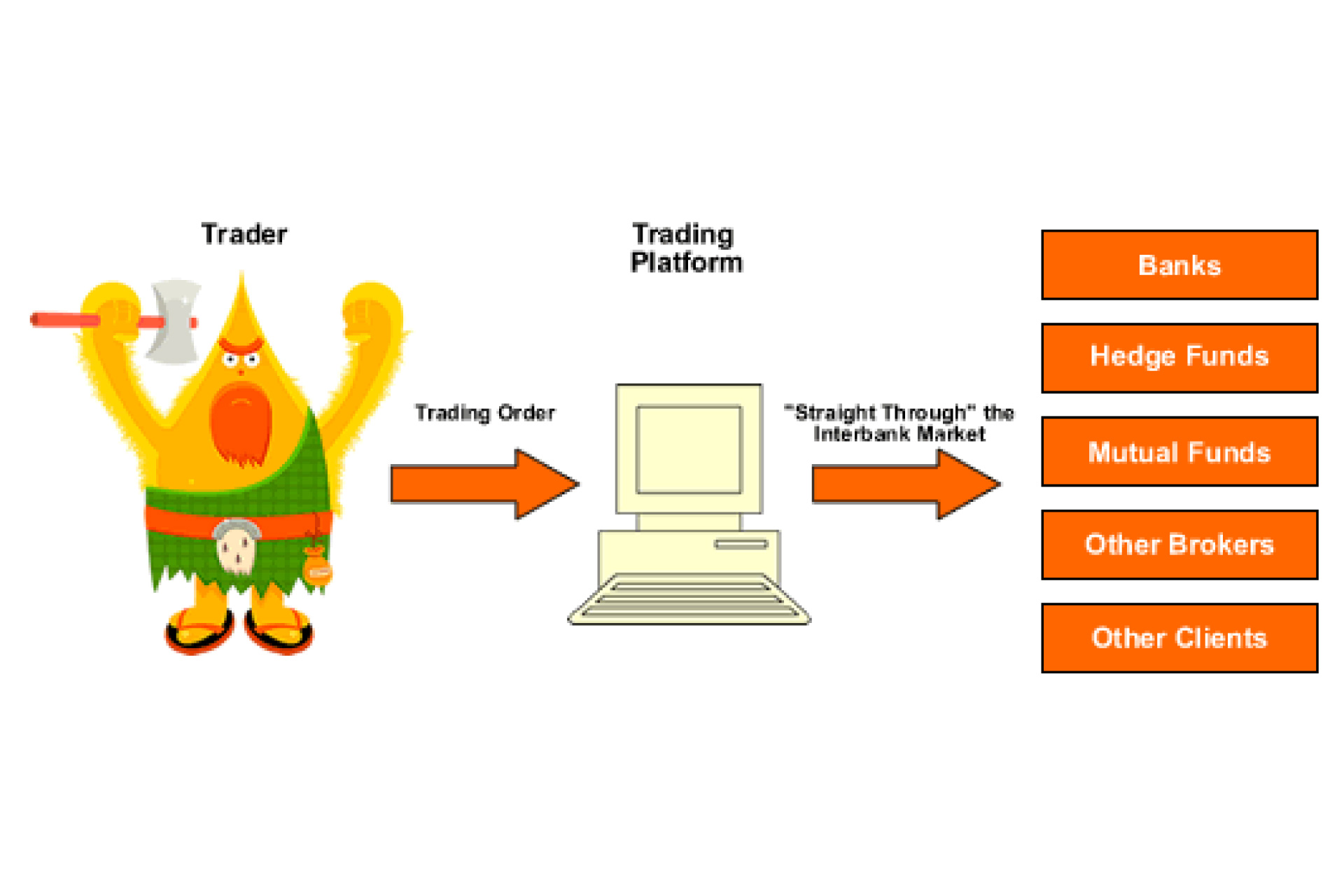

As the name suggests, No Dealing Desk (NDD) brokers do NOT pass their clients’ orders through a Dealing Desk.

This means that they do not take the other side of their clients’ trade as they simply link two parties together.

NDDs are like bridge builders: they build a structure over an otherwise impassable or hard-to-pass terrain to connect two areas.

NDDs can either charge a very small commission for trading or just put a markup by increasing the spread slightly.

No Dealing Desk brokers can either be STP or STP+ECN.

What is an STP Broker?

Some brokers claim that they are true ECN brokers, but in reality, they merely have a Straight Through Processing system.

Forex brokers that have an STP system route the orders of their clients directly to their liquidity providers who have access to the interbank market.

NDD STP brokers usually have many liquidity providers, with each provider quoting its own bid and ask price.

Let’s say your NDD STP broker has three different liquidity providers. In their system, they will see three different pairs of bid and ask quotes.

| Bid | Ask | |

|---|---|---|

| Liquidity Provider A | 1.2998 | 1.3001 |

| Liquidity Provider B | 1.2999 | 1.3001 |

| Liquidity Provider C | 1.3000 | 1.3002 |

Their system then sorts these bid and ask quotes from best to worst. In this case, the best price in the bid side is 1.3000 (you want to sell high) and the best price on the ask side is 1.3001 (you want to buy low). The bid/ask is now 1.3000/1.3001.

Will this be the quote that you will see on your platform?

Of course not!

Your broker isn’t running a charity! Your broker didn’t go through all that trouble of sorting through those quotes for free!

To compensate them for their trouble, your broker adds a small, usually fixed, markup. If their policy is to add a 1-pip markup, the quote you will see on your platform would be 1.2999/1.3002.

You will see a 3-pip spread. The 1-pip spread turns into a 3-pip spread for you.

So when you decide to buy 100,000 units of EUR/USD at 1.3002, your order is sent through your broker and then routed to either Liquidity Provider A or B.

If your order is acknowledged, Liquidity Provider A or B will have a short position of 100,000 units of EUR/USD 1.3001, and you will have a long position of 100,000 units of EUR/USD at 1.3002. Your broker will earn 1 pip in revenue.

This changing bid/ask quote is also the reason why most STP type brokers have variable spreads. If the spreads of their liquidity providers widen, they have no choice but to widen their spreads too.

While some STP brokers do offer fixed spreads, most have VARIABLE spreads.

What is an ECN Broker?

True ECN forex brokers, on the other hand, allow the orders of their clients to interact with the orders of other participants in the ECN.

Participants could be banks, retail traders, hedge funds, and even other brokers. In essence, participants trade against each other by offering their best bid and ask prices.

ECNs also allow their clients to see the “Depth of Market.”

Depth of Market displays where the buy and sell orders of other market participants are. Because of the nature ECN, it is very difficult to slap on a fixed markup so ECN brokers usually get compensated through a small COMMISSION.