Day trading is a popular trading strategy where you buy and sell a financial instrument over a time frame of a single day’s trading with the intention of profiting from small price movements.

Day trading is another short term trading style, but unlike scalping, you are typically only taking one trade a day and closing it out when the day is over.

These traders like picking a side at the beginning of the day, acting on their bias, and then finishing the day with either a profit or a loss.

They DON’T like holding their trades overnight.

Day trading is suited for forex traders that have enough time throughout the day to analyze, execute and monitor a trade.

If you think scalping is too fast but swing trading is a bit slow for your taste, then day trading might be for you.

You might be a forex day trader if:

- You like beginning and ending a trade within one day.

- You have time to analyze the markets at the beginning of the day and can monitor it throughout the day.

- You like to know whether or not you win or lose at the end of the day.

You might NOT be a forex day trader if:

- You like longer or shorter term trading.

- You don’t have time to analyze the markets and monitor it throughout the day.

- You have a day job.

Some things to consider if you decide to day trade:

Stay informed on the latest fundamentals events to help you choose a direction

You will want to keep yourself up-to-date on the latest economic news so that you can make your trading decisions at the beginning of the day.

Do you have time to monitor your trade?

If you have a full-time job, consider how you will manage your time between your work and trading. Basically….don’t get fired from your job because you are always looking at your charts!

Types of Day Trading

Day traders looking to maximize intraday profits often use one or multiple of the following day trading strategies.

Trend Trading

Trend trading is when you look at a longer time frame chart and determine an overall trend.

Once the overall trend is established, you move to a smaller time frame chart and look for trading opportunities in the direction of that trend.

Using indicators on the shorter time frame chart will give you an idea of when to time your entries. For an example of this style of trading, see Pip Surfer’s world-renowned Cowabunga System.

First, determine what the overall trend is by looking at a longer time frame.

You can use indicators to help you confirm the trend.

Once you determine the overall trend, you can then move to a smaller timeframe and look for entries in the same direction.

Remember this? It’s called Multiple Time Frame Analysis!

Countertrend Trading

Countertrend day trading is similar to trend trading except that once you determine your overall trend, you look for trades in the opposite direction.

The idea here is to find the end of a trend and get in early when the trend reverses. This is a little riskier but can have huge payoffs.

In this example, we see that there was a long and exhausted downtrend on the 4hr chart. This gives us. an indication that the market may be ready for a reversal.

Since our thinking is “counter-trend”, we would look for trades in the opposite direction of the overall trend on a smaller timeframe such as a 15-minute chart.

Traders who use this strategy need to be quick to spot the end of a trend in order to open a position at the optimal entry point.

This strategy is fighting the trend and can work against traders at times.

Remember that going opposite of the trend is very risky, but if timed correctly, it can have huge rewards!

Countertrend trading favors those who know recent price action really well and so know when to bet against it.

Range Trading

Range trading, sometimes referred to as channel trading, is a day trading strategy that starts with an understanding of the recent price action.

A trader will inspect chart patterns to identify typical highs and lows during the day while keeping a close eye on the difference between these points.

For example, if the price has been rising off a support level or falling off a resistance level, then a trader might choose to buy or sell based on their perception of the market’s direction.

This is known as “trading in a range“, where each time price hits a high, it falls back to the low. And vice versa.

A day trader who is using this strategy who is looking to go long will buy around the low price and sell at the high price.

A day trader who is using this strategy who is looking to go short will sell around the high price and buy at the low price.

Most range traders will use stop losses and limit orders to keep their trading in line with what they perceive to be happening in the market.

A stop loss order is the point at which a position is automatically closed out if the price of the security drops below the trader’s entry point.

A limit order is the automatic closing of a position at the point where the trader perceives a profitable run could end.

Range trading requires enough volatility to keep the price moving for the duration of the day, but not so much volatility that the price breaks out of the range and starts a new trend.

But if the price does break out, there’s a strategy for that as well…

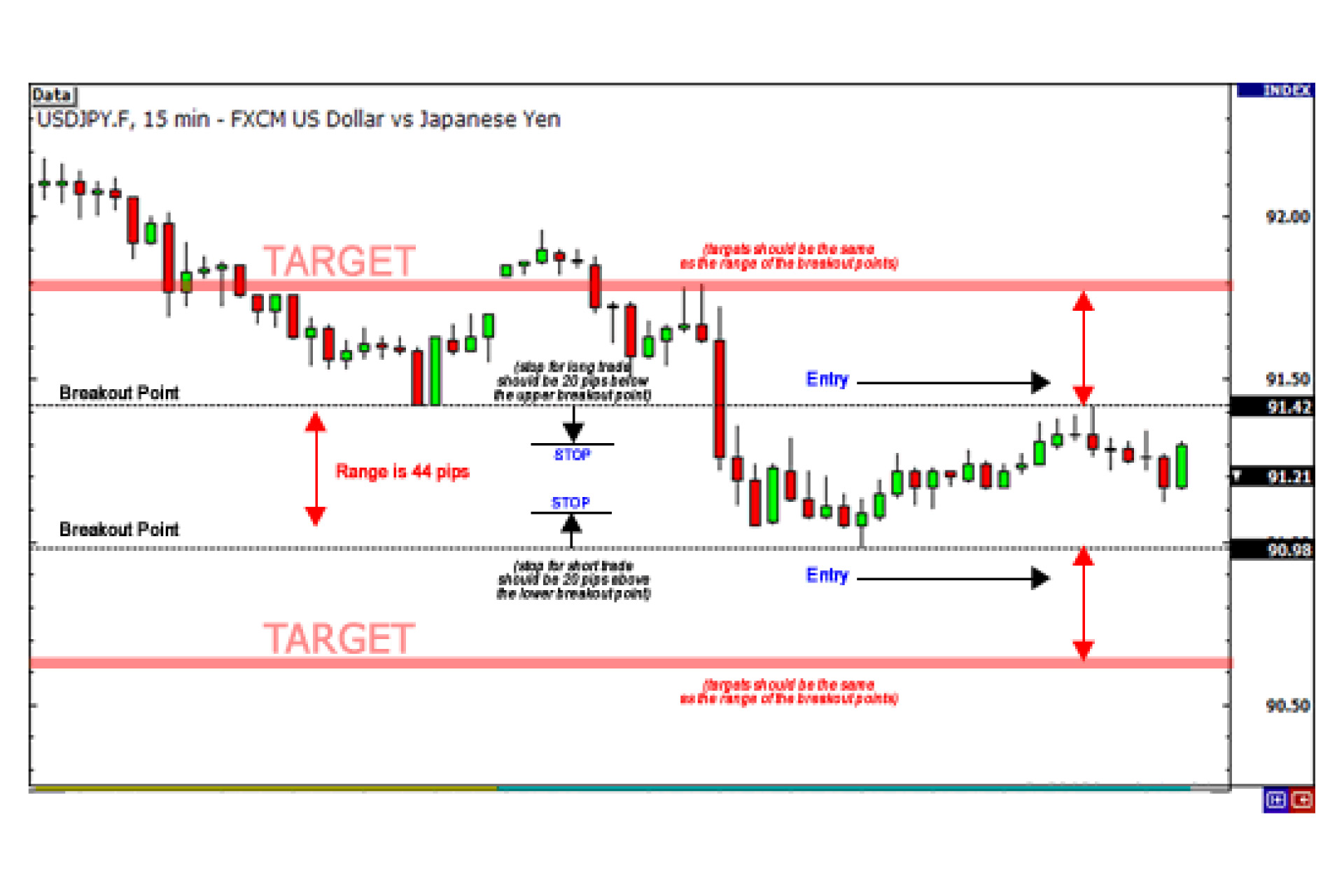

Breakout Trading

Breakout trading is when you look at the range a pair has made during certain hours of the day and then placing trades on either side, hoping to catch a breakout in either direction.

This is particularly effective when a pair has been a tight range because it is usually an indication that the pair is about to make a big move.

Your goal here is to set yourself up so that when the move takes place you are ready to catch the wave!

In breakout trading, you determine a range where support and resistance have been holding strongly.

Once you do, you can set entry points above and below your breakout levels.

As a rule of thumb, you want to target the same amount of pips that makes up your determined range.

Make sure you check out our “Trading Breakouts” lesson so you get this down pat!

News Trading

News trading is one of the most traditional, predominantly short term-focused trading strategies used by day traders.

Someone who is news trading pays less attention to charts and technical analysis. They wait for information to be released that they believe will drive prices in one direction or the other.

This information could be a report releasing economic data, such as unemployment, interest rates or inflation, or simply breaking news or random presidential tweets.

To do well with news trading, day traders tend to have a solid understanding of the markets in which they’re trading.

They develop the insights to determine how the news will be received by the market in question in terms of the extent to which its price will be affected.

They will be alert to various different news sources at the same time and know when to enter the market.

The drawback of news trading is that events that cause substantial movements in prices are usually rare.

More often than not, the expectations of such events are factored into the price in the run up to the announcement.

If you’re interested in news trading, we devote an entire section to it in our School of Pipsology called “Trading the News“.