There are several fundamental factors that help shape the long-term strength or weakness of the major currencies and will affect you as a forex trader.

We’ve included what we think are the most important for your reading pleasure:

Economic Growth and Outlook

We start easy with the economy and outlook held by consumers, businesses, and governments.

It’s easy to understand that when consumers perceive a strong economy.

Consumers feel happy and safe, and they spend money. Companies willingly take this money and say, “Hey, we’re making money! Wonderful! Now… uh, what do we do with all this money?”

Companies with money spend money. And all this creates some healthy tax revenue for the government.

Weak economies, on the other hand, are usually accompanied by consumers who aren’t spending, businesses who aren’t making any money and aren’t spending, so the government is the only one still spending. But you get the idea.

Both positive and negative economic outlooks can have a direct effect on the currency markets.

The most commonly used measure of economic growth is GDP.

GDP stands for “Gross Domestic Product” and represents the total monetary value of all final goods and services produced (and sold) within a country during a period of time (typically one year).

GDP provides an economic snapshot of a country, used to estimate the size of an economy and growth rate.

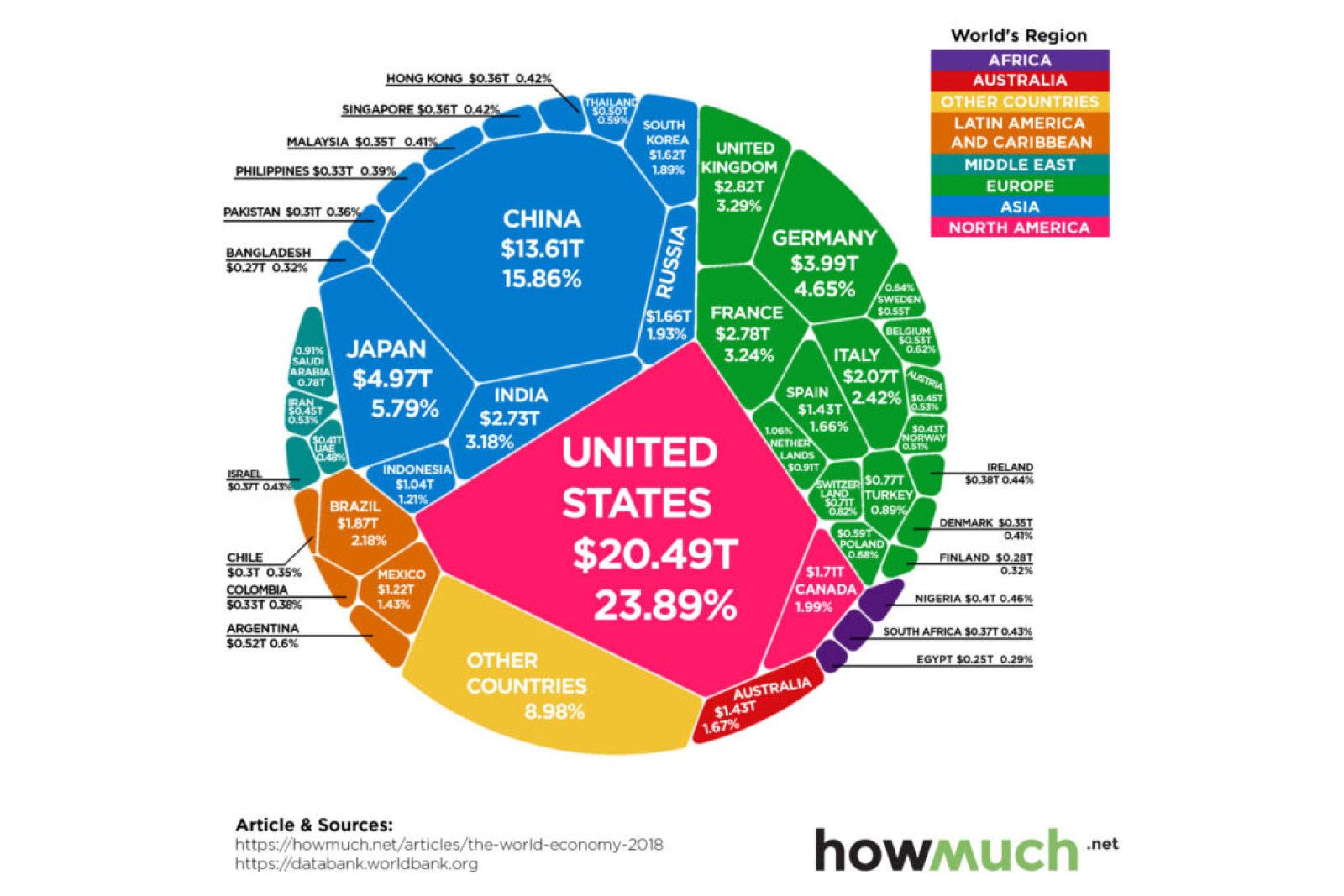

Here’s a visualization from HowMuch.net that shows the $86 TRILLION global economy in one chart:

As you can see:

- The United States is still the world’s largest economy.

- China is the world’s second-largest economy.

- The United States and China together make up nearly 40% of the global economic GDP.

- The top 15 economies represent a whopping 75% of the total global GDP.

Capital Flows

Globalization, technological advances, and the internet have all contributed to the ease of investing your money virtually anywhere in the world, regardless of where you call home.

You’re only a few clicks of the mouse away (or a phone call for you folks living in the Jurassic era of the 2000s) from investing in the New York or London Stock exchange, trading the Nikkei or Hang Seng index, or from opening a forex account to trade U.S. dollars, euros, yen, and even exotic currencies.

Capital flows measure the amount of money flowing into and out of a country or economy because of capital investment purchasing and selling.

Currency analysts and traders alike take the news and try to dissect the overall tone and language of the announcement, taking special care to do this when interest rate changes or economic growth information are involved.

Much like how the market reacts to the release of other economic reports or indicators, forex traders react more to central bank activity, and interest rate changes when they don’t fall in line with current market expectations.

It’s getting easier to foresee how a monetary policy will develop over time, due to increasing transparency by central banks.

Yet there’s always a possibility that central bankers will change their outlook in greater or lesser magnitude than expected.

It’s during these times that market VOLATILITY is high and care should be taken with existing and new trade positions!

The important thing you want to keep track of is capital flow balance, which can be positive or negative.

When a country has a positive capital flow balance, foreign investments coming into the country are greater than investments heading out of the country.

A negative capital flow balance is the direct opposite. Investments leaving the country for some foreign destinations are greater than investments coming in.

With more investment coming into a country, demand increases for that country’s currency as foreign investors have to sell their currency in order to buy the local currency.

This demand causes the currency to increase in value.

Simple supply and demand.

And you guessed it, if supply is high for a currency (or demand is weak), the currency tends to lose value.

When foreign investments make an about-face, and domestic investors also want to switch teams and leave, and then you have an abundance of the local currency as everybody is selling and buying the currency of whatever foreign country or economy they’re investing in.

Foreign capital loves nothing more than a country with high-interest rates and strong economic growth. If a country also has a growing domestic financial market, even better!

A booming stock market, high-interest rates… What’s not to love?! Foreign investment comes streaming in.

And again, as demand for the local currency increases so does its value.

Trade Flows and Trade Balance

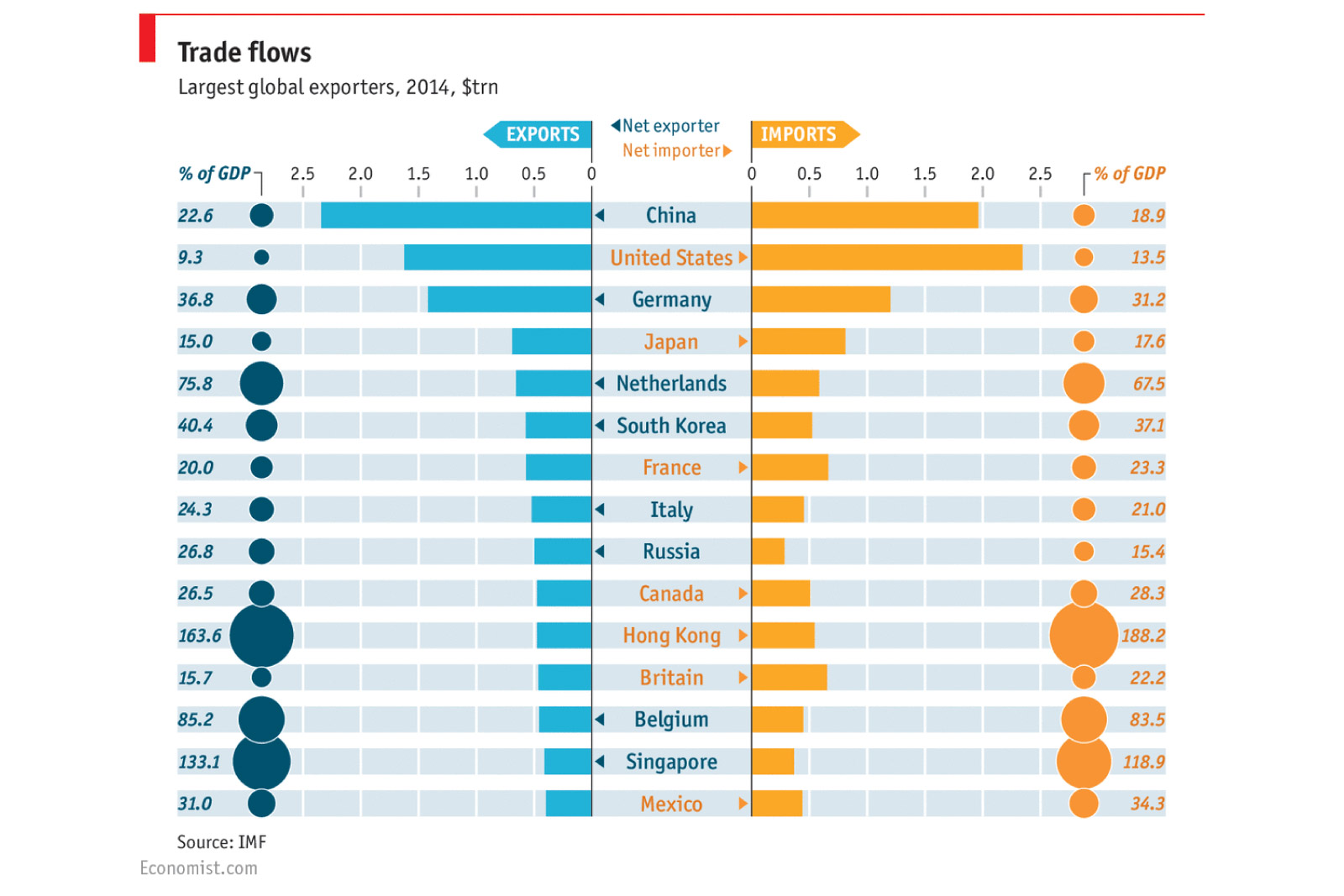

International trade can be broadly distinguished between trade in goods (merchandise) and services. The bulk of international trade concerns physical goods, while services account for a much lower share.

World trade in goods has increased dramatically over the last decade, rising from about $10 trillion in 2005 to more than $18.89 trillion in 2019.

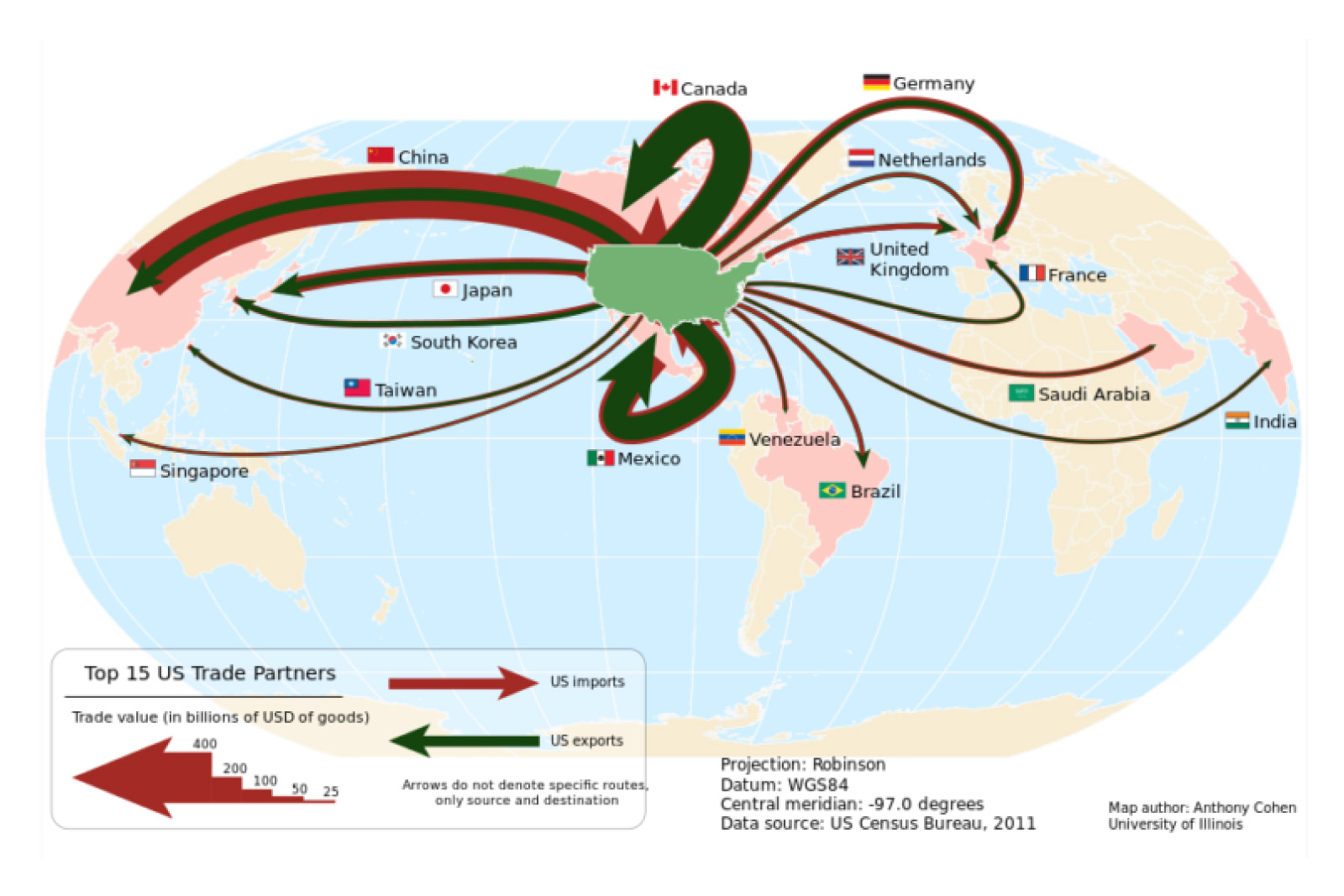

We’re living in a global marketplace. Countries sell their own goods to countries that want them (exporting), while at the same time buying goods they want from other countries (importing).

Have a look around your house. Most of the stuff (electronics, clothing, doggie toys) lying around is probably made outside of the country you live in.

If you live in the United States, look at all the different countries that the U.S. trades with.

Every time you buy something, you have to give up some of your hard-earned cash.

Whoever you buy your widget from has to do the same thing.

U.S. importers exchange money with Chinese exporters when they buy goods. And Chinese imports exchange money with European exporters when they buy goods.

All this buying and selling is accompanied by the exchange of money, which in turn changes the flow of currency into and out of a country.

Trade balance (or balance of trade or net exports) measures the ratio of exports to imports for a given economy.

It demonstrates the demand for that country’s goods and services, and ultimately it’s currency as well.

If exports are higher than imports, a trade surplus exists and the trade balance is positive.

If imports are higher than exports, a trade deficit exists, and the trade balance is negative.

So:

Exports > Imports = Trade Surplus = Positive (+) Trade Balance

Imports > Exports = Trade Deficit = Negative (-) Trade Balance

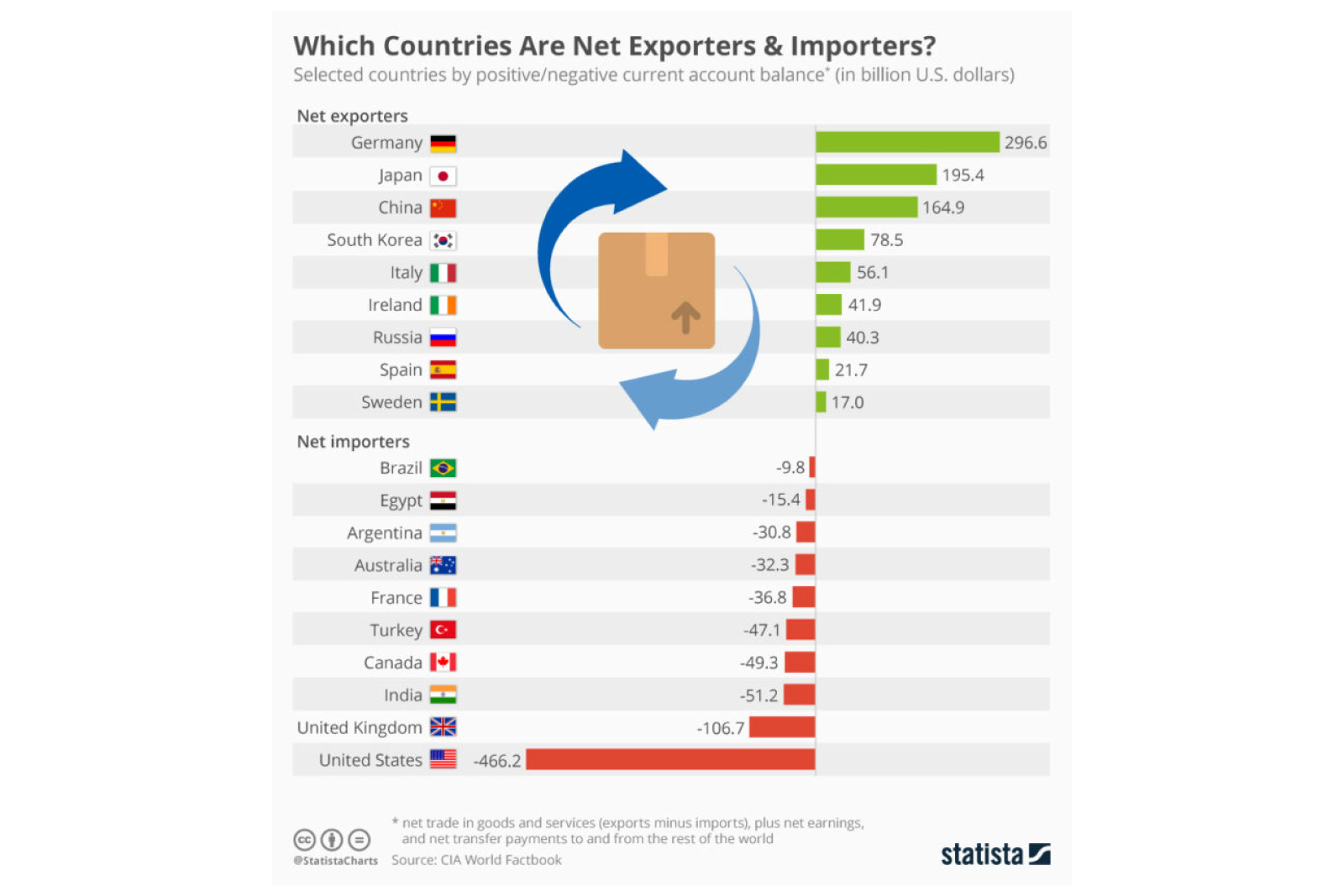

Trade deficits have the prospect of pushing a currency price down compared to other currencies.

Net importers first have to sell their currency in order to buy the currency of the foreign merchant who’s selling the goods they want.

When there’s a trade deficit, the local currency is being sold to buy foreign goods.

Because of that, the currency of a country with a trade deficit is less in demand compared to the currency of a country with a trade surplus.

Net exporters, countries that export more than they import, see their currency being bought more by countries interested in buying the exported goods.

Trade surpluses tend to experience currency appreciation.

It is in more demand, helping their currency to gain value.

It’s all due to the DEMAND for the currency.

That’s because when exporters convert the foreign currencies they earn abroad into their domestic currency, this tends to put upward pressure on the domestic currency.

Currencies in higher demand tend to be valued higher than those in less demand.

It’s similar to pop stars. Because she’s more in demand, Taylor Swift gets paid more than Pink. Same thing with Justin Bieber versus Vanilla Ice.

The Government: Present and Future

After the Great Financial Crisis (GFC) caused the Great Recession during the late 2000s, all eyes were glaringly watching their respective country’s governments, wondering about the financial difficulties being faced, and hoping for some sort of fiscal responsibility that would end the woes felt in our wallets.

A decade later, we now face a similar situation as the world tries to navigate a global health crisis and economic collapse caused by the coronavirus (COVID-19) pandemic.

Instability in the current government or changes to the current administration can have a direct bearing on that country’s economy and even neighboring nations. And any impact on an economy will most likely affect exchange rates.