So how do we spot a trend?

The indicators that can do so have already been identified as MACD and moving averages.

These indicators will spot trends once they have been established, at the expense of delayed entry.

The bright side is that there’s less chance of being wrong.

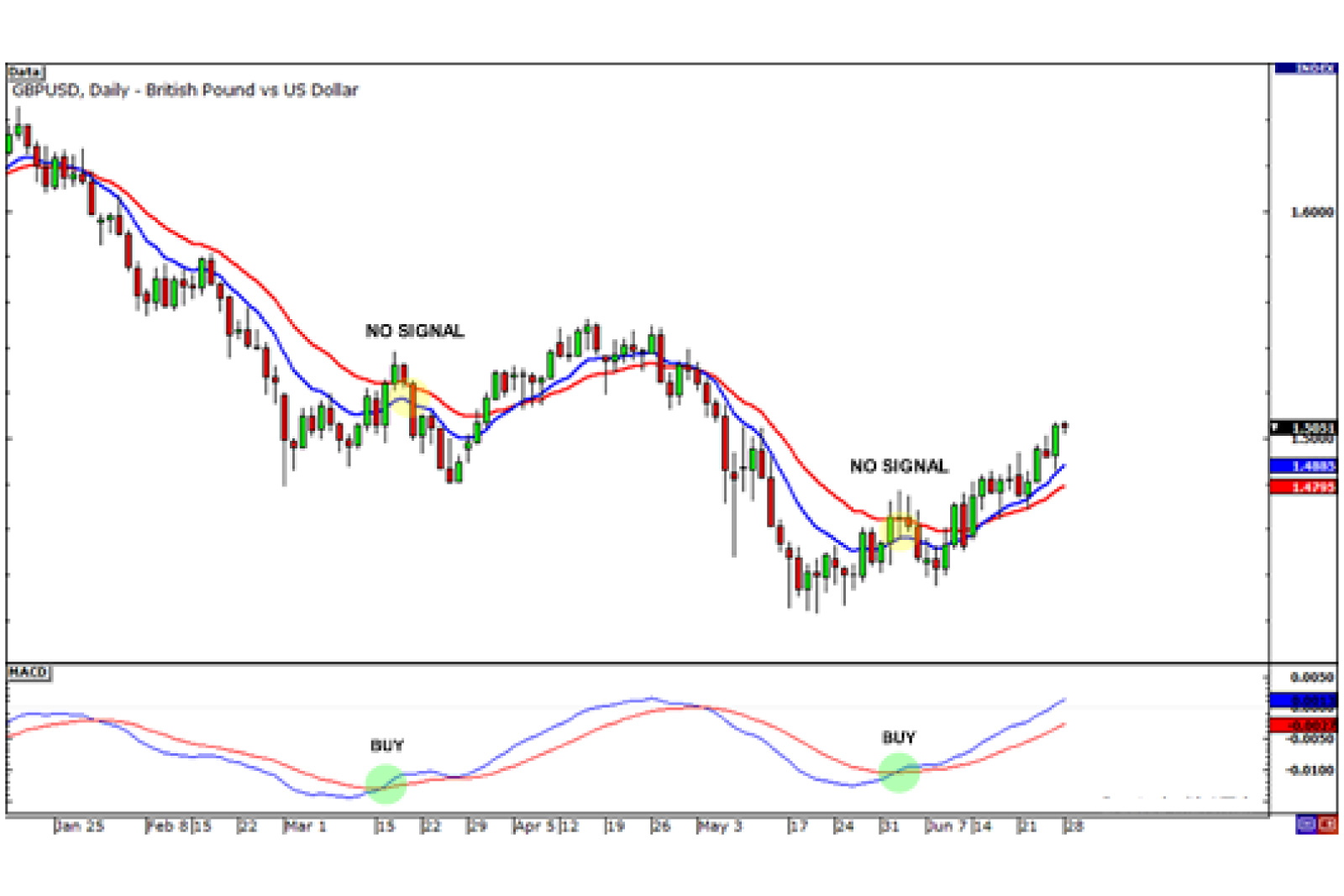

On GBP/USD’s daily chart above, we’ve put on the 10 EMA (blue), 20 EMA (red), and the MACD.

Around October 15, the 10 EMA crossed above the 20 EMA, which is a bullish crossover.

Similarly, the MACD made an upward crossover and gave a buy signal.

If you jumped in on a long trade back then, you would’ve enjoyed that nice uptrend that followed.

Later on, both the moving averages and MACD gave a couple of sell signals.

And judging from the strong downtrends that occurred, taking those short trades would’ve given huge profits.

We can see those dollar signs flashing in your eyes!

Now let’s look at another chart so you can see how these crossover signals can sometimes give false signals.

We like to call them “fakeouts.”

On March 15, the MACD made a bullish crossover while the moving averages gave no signal whatsoever.

If you acted on that buy signal from the MACD, you just suffered a fakeout, buddy.

Similarly, the MACD’s buy signal by the end of May wasn’t accompanied by any moving average crossover.

If you entered a long trade right then and there, you might’ve set yourself up for a loss since the price dipped a bit after that.

Bummer!