In your trading platform, you will see something that says “Unrealized P/L” or “Floating P/L” with green or red numbers beside them.

In this lesson, we explain what Unrealized P/L and Floating P/L are.

When trading, there are actually two different types of “profit or loss”, also known as “P/L”.

Both are important. Let’s discuss the difference between the two.

Unrealized P/L

Unrealized P/L refers to the profit or loss held in your current open positions….your currently active trades.

This is equal to the profit or loss that would be “realized” if all your open positions were closed immediately.

Unrealized P/L is also known as “Floating P/L” because the value is constantly changing since your positions are still open.

Your unrealized P/L continuously fluctuates (or “floats”) with the current market prices if you have open positions.

For example, if you currently have an unrealized profit, if price move against you, the unrealized profit can become an unrealized loss.

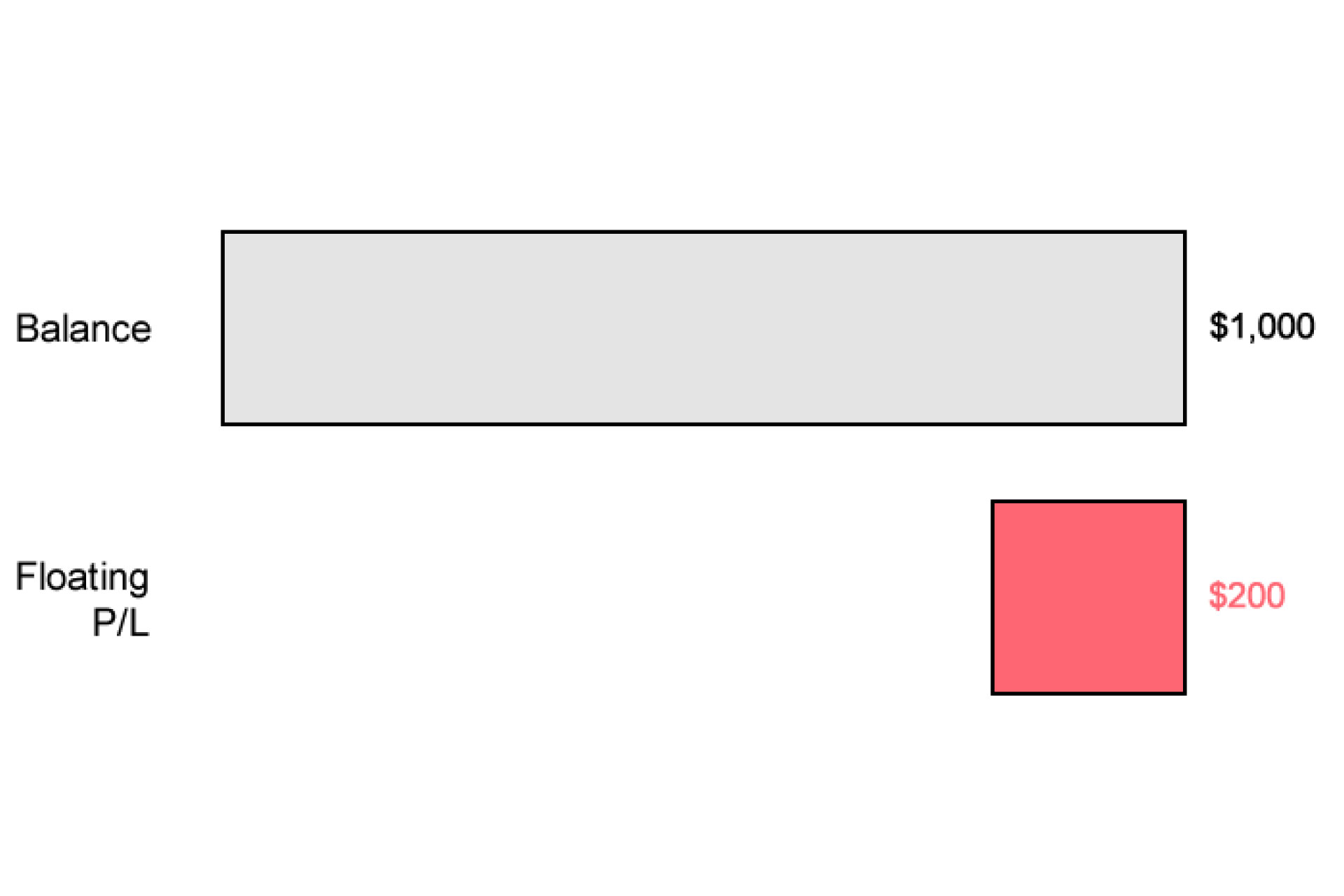

Example: Floating Loss

Let’s say your account is in USD and you are currently long 10,000 units EUR/USD, which was bought at 1.15000.

The current exchange rate for EUR/USD is 1.13000.

Let’s calculate the position’s Floating P/L:

Floating P/L = Position Size x (Current Price – Entry Price)

Floating P/L = 10,000 x (1.13000 – 1.15000)

-200 = 10,000 x (- 0.0200)

The position is down 200 pips.

Since you’re trading a mini lot, each pip is worth $1.

So you currently have a Floating Loss of $200 (200 pips x $1).

It is a Floating Loss because you have NOT closed the trade yet.

Usually, when a loss remains floating, you are hoping that the price will turn around.

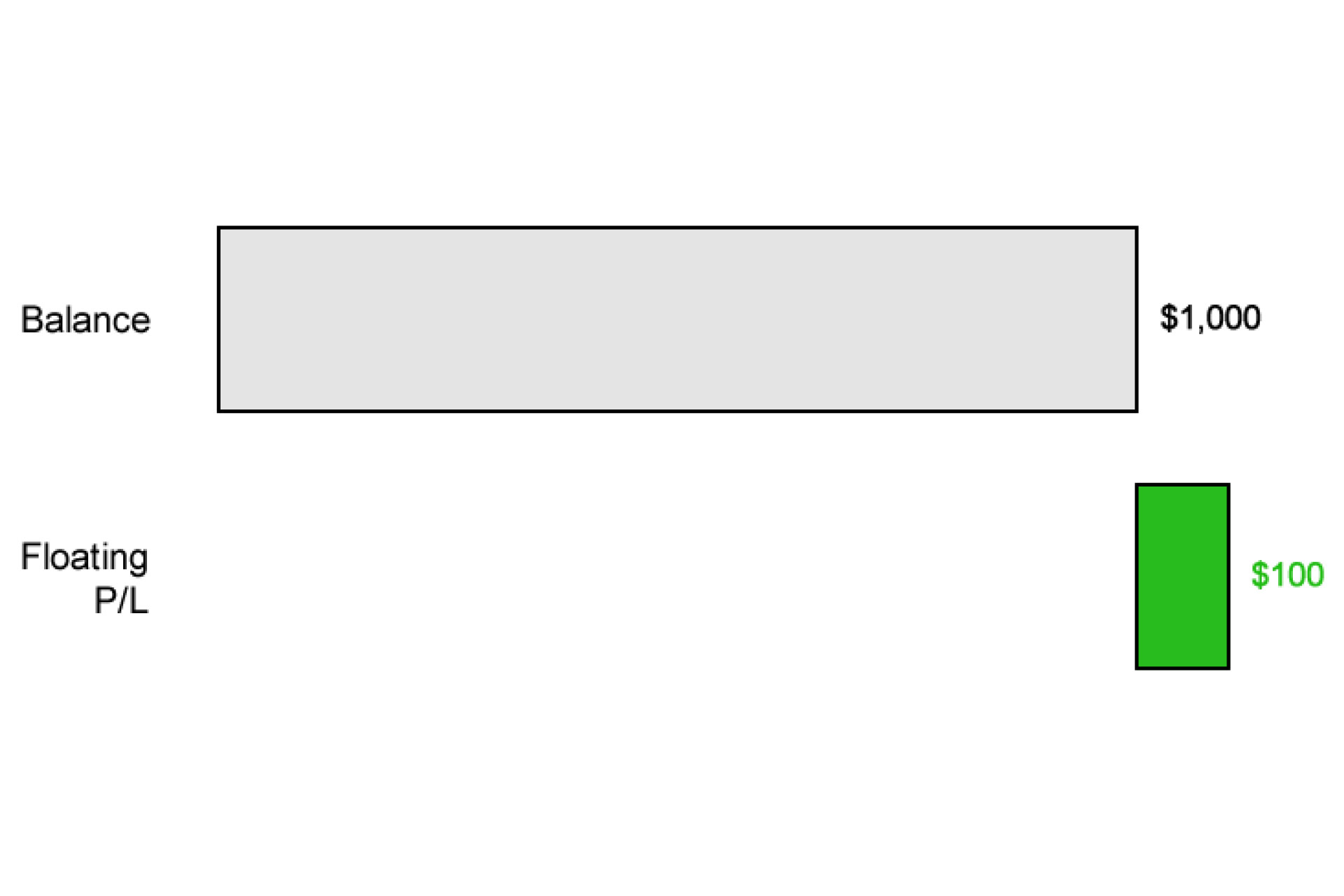

If EUR/USD rose above your original entry price to 1.16000, then you would now have a Floating Profit.

The position is now up 100 pips.

Since you’re trading a mini lot, each pip is worth $1.

So you currently have a Floating Profit of $100 (100 pips x $1).

Realized P/L

A Realized Profit is profit that comes from a completed trade.

Same thing with a loss.

A Realized Loss is a loss that comes from a completed trade.

In other words, your profits or losses only become realized when the positions are CLOSED.

This is the only time when your account balance will change to reflect any gains or losses.

If you closed a position with profits, your account balance will increase. If you closed with losses, then your account balance will decrease.

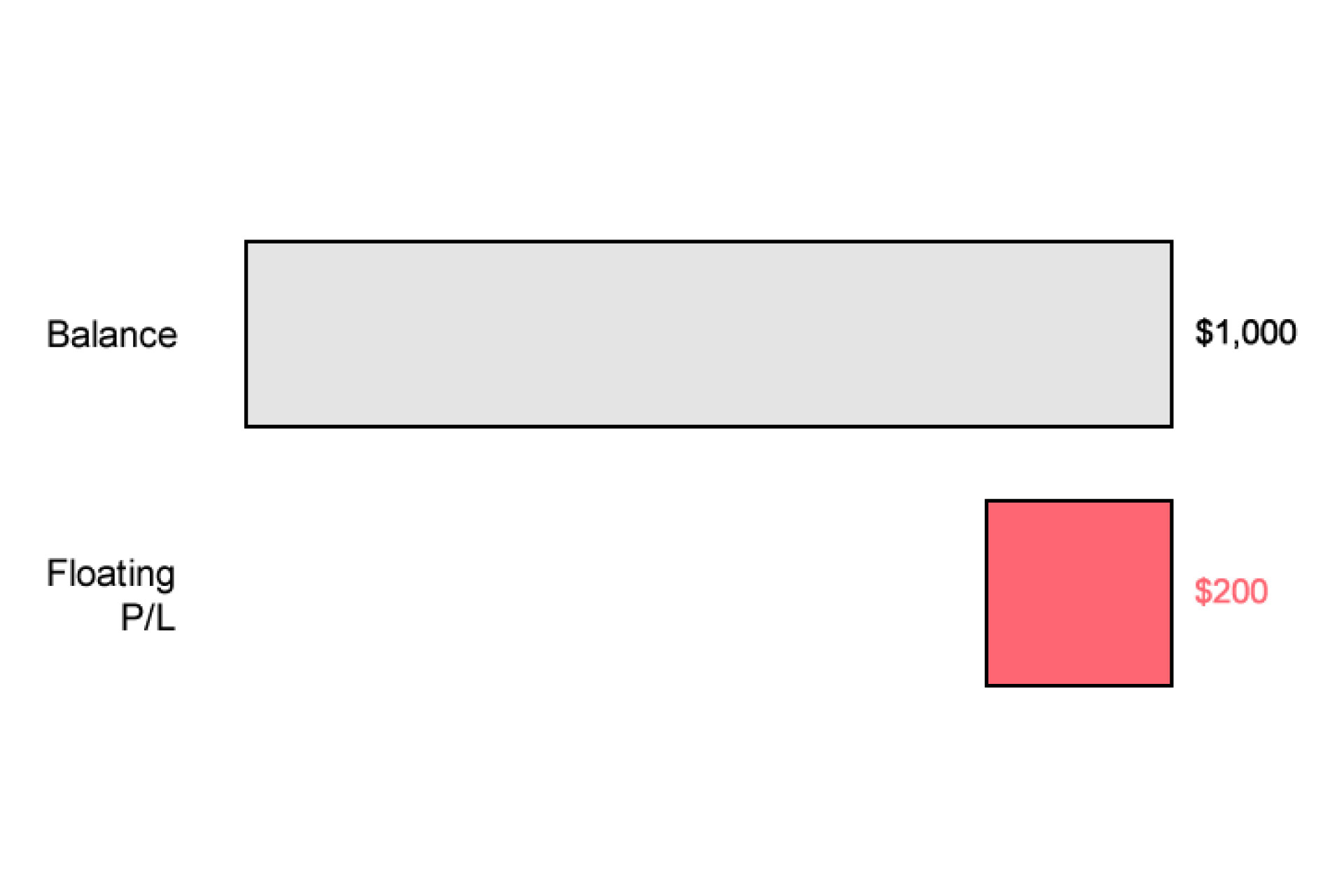

Example: Realized Loss

Let’s say your account is in USD and you are currently long 10,000 units of EUR/USD, which was bought at 1.15000.

The current exchange rate for EUR/USD is 1.13000.

Let’s calculate the position’s Floating P/L:

Floating P/L = Position Size x (Current Price – Entry Price)

Floating P/L = 10,000 x (1.13000 – 1.15000)

-200 = 10,000 x (- 0.0200)

The position is down 200 pips.

And since you’re trading a mini lot, each pip is worth $1.

So you currently have a Floating Loss of $200 (200 pips x $1).

It is a floating loss because you have NOT closed the trade yet.

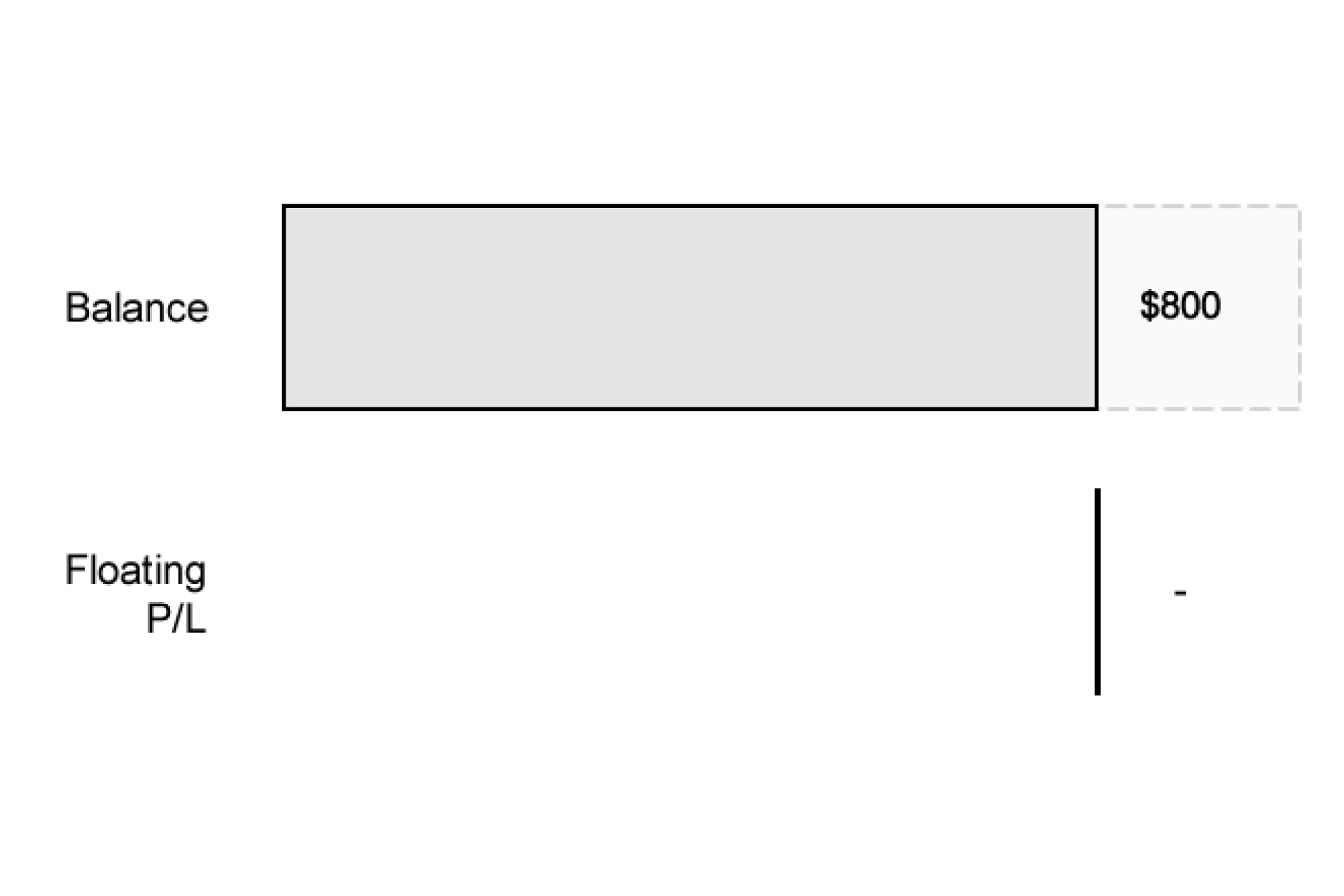

But you can’t stomach losing anymore and decide to close the trade right then and there.

You’ve realized the $200 loss and the cash is DEDUCTED from your account balance.

When you opened the trade, you had $1,000 as your Balance.

But after you closed the trade with a $200 loss, your Balance is now $800.

| Balance | Floating P/L | |

| BEFORE | $1,000 | -$200 |

| AFTER | $800 | – |

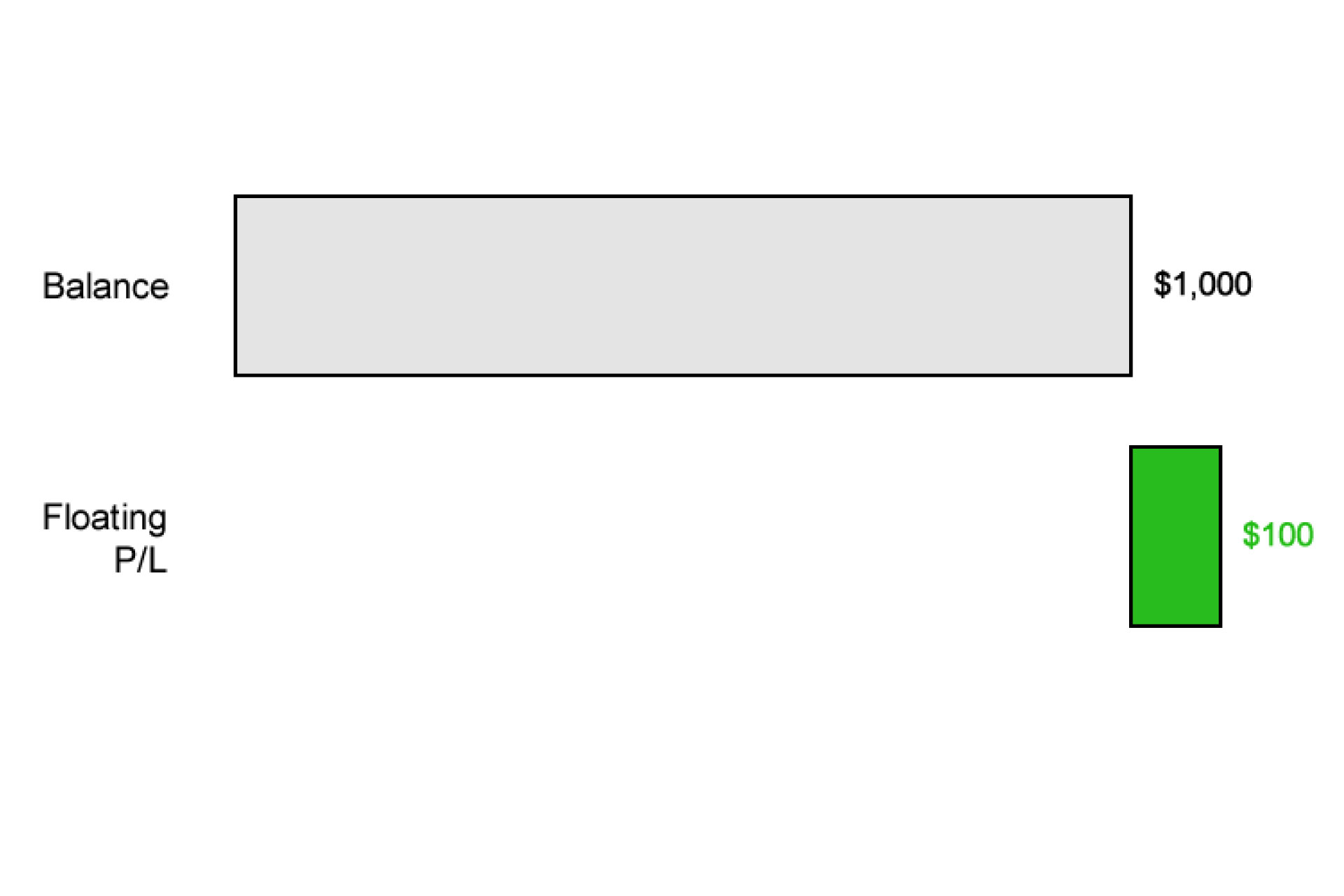

Example: Realized Profit

Let’s say your account is in USD and you are currently long 10,000 units of EUR/USD, which was bought at 1.15000

The current exchange rate for EUR/USD is 1.16000.

Let’s calculate the position’s Floating P/L:

Floating P/L = Position Size x (Current Price – Entry Price)

Floating P/L = 10,000 x (1.16000 – 1.15000)

100 = 10,000 x (0.0100)

The position is up 100 pips.

And since you’re trading a mini lot, each pip is worth $1.

So you currently have a Floating Profit of $100 (100 pips x $1).

It is a floating profit because you have NOT closed the trade yet.

You hear a voice out of nowhere to exit your trade.

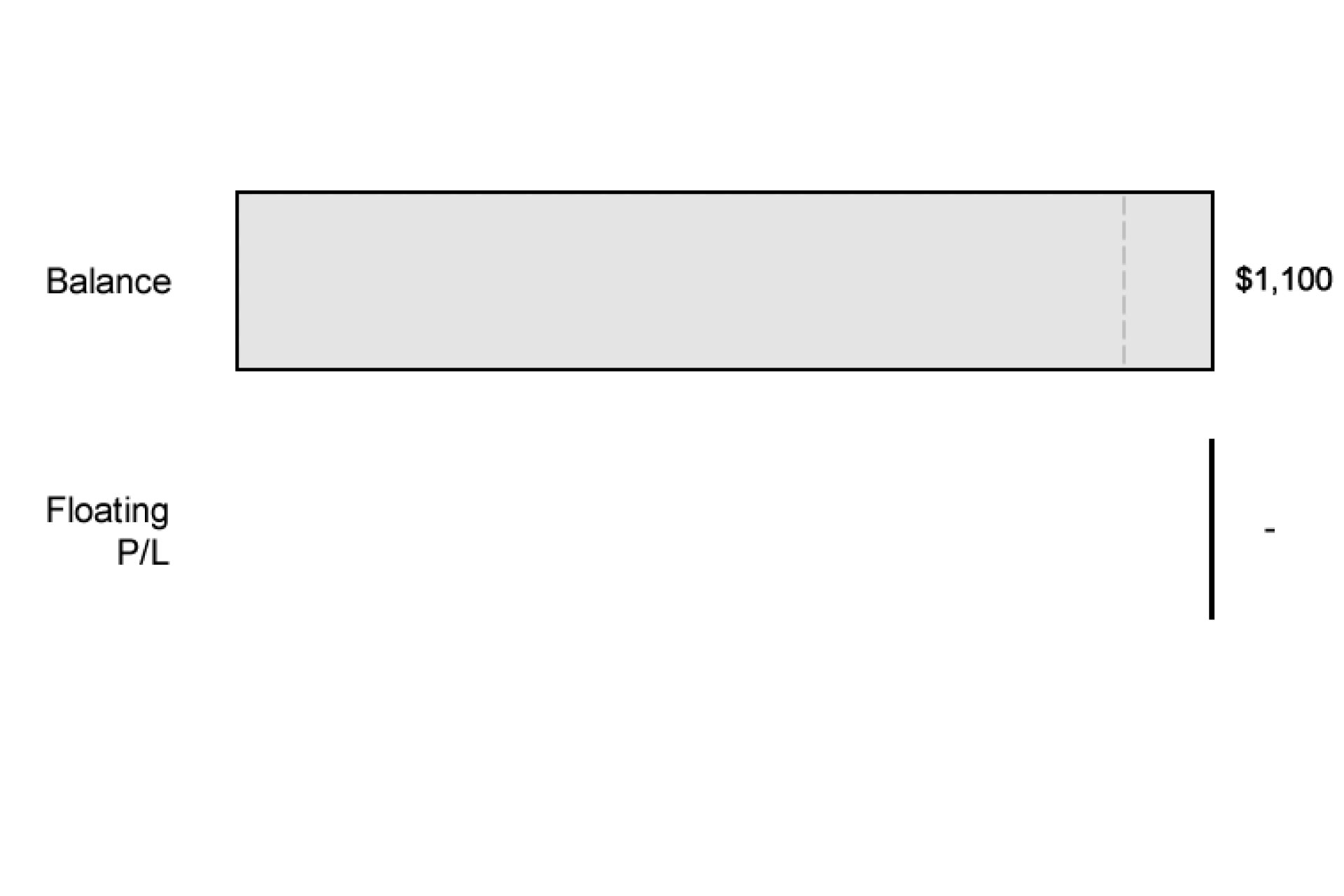

So you close the trade.

You’ve realized the $100 gain and the cash is ADDED to your account balance.

When you opened the trade, you had $1,000 as your Balance.

But after you closed the trade with a $100 gain, your Balance is now $1,100.

Profit Isn’t Real Until It’s Realized

The difference between realized and unrealized profit is subtle, but it can mean the difference between a profitable trade or a losing trade.

It is important for traders to clearly know how to differentiate between “realized” P/L and “unrealized” P/L

- Realized profits are gains that have been converted into cash and ADDED to your account balance.

- Realized losses are losses that have been converted into cash and DEDUCTED from your account balance.

In order words, for you to realize profits from a trade you’ve made, you must receive cash and not simply observe the value of your trade increase without exiting the trade.

Unrealized profit is theoretical profit or “paper profit” that is currently available, but could be taken away at any moment if the price moves against the trade.

When it comes to love, think about “the one” that got away. At one point in your life, he or she was an “unrealized” spouse.

You never built up the courage to pop the question and now you’re forever heartbroken with a “realized” loss of the perfect spouse.

This is exactly what happened to Bob.

To this day, Bob is still single.

This depressing life lesson from Bob’s sad love story can be applied to trading.

If you have not closed out of your position and “realized” your gain, you could still lose some, or all, of your profits.

Realized profit is real profit that can no longer be affected by price changes because it is no longer part of an active trade.

It is real money that is added to your Balance and can be withdrawn from your trading account and transferred into your bank account.

Recap

In this lesson, we learned about the following:

- Unrealized P/L or Floating P/L refers to the profit or loss held in your current open positions….your currently active trades.

- Realized P/L refers to profit or loss from a completed trade.

In previous lessons, we learned:

- What is Margin Trading? Learn why it’s important to understand how your margin account works.

- What is Balance? Your account balance is the cash you have available in your trading account.

Let’s move on and learn about the concept of margin.