Each retail forex broker or CFD provider sets their own Margin Call Level and Stop Out Level.

It’s crucial to know what your broker’s Margin Call and Stop Out Levels are!

A lot of traders don’t even bother to find out what they are before opening their account, they just jump right into trading!

These levels are frequently ignored or overlooked by traders to the detriment of their account!

Different forex brokers handle a Margin Call in different ways.

Some brokers treat a Margin Call and Stop Out as one and the same, meaning they will not send you a warning message, they will simply just start closing your trades along with a message notifying you of the action!

For example, a broker may set their Margin Call Level at 100% with no separate Stop Out Level.

This means that if your Margin Level drops lower than 100%. the broker will automatically close your position without any warnings!

Other brokers treat a Margin Call and Stop Out differently. They use a Margin Call as a sort of an early warning message that your positions are at risk of being liquidated Stop Out).

For example, a broker may set their Margin Call Level at 100% and their Stop Out Level at 20%.

This means that if your Margin Level drops lower than 100%, you will receive a WARNING from your broker that you need to close your trade or deposit more money or risk reaching the Stop Out Level.

If your Margin Level continues to drop and reaches 20%, then and only then, will the broker automatically close your position (at the best available price).

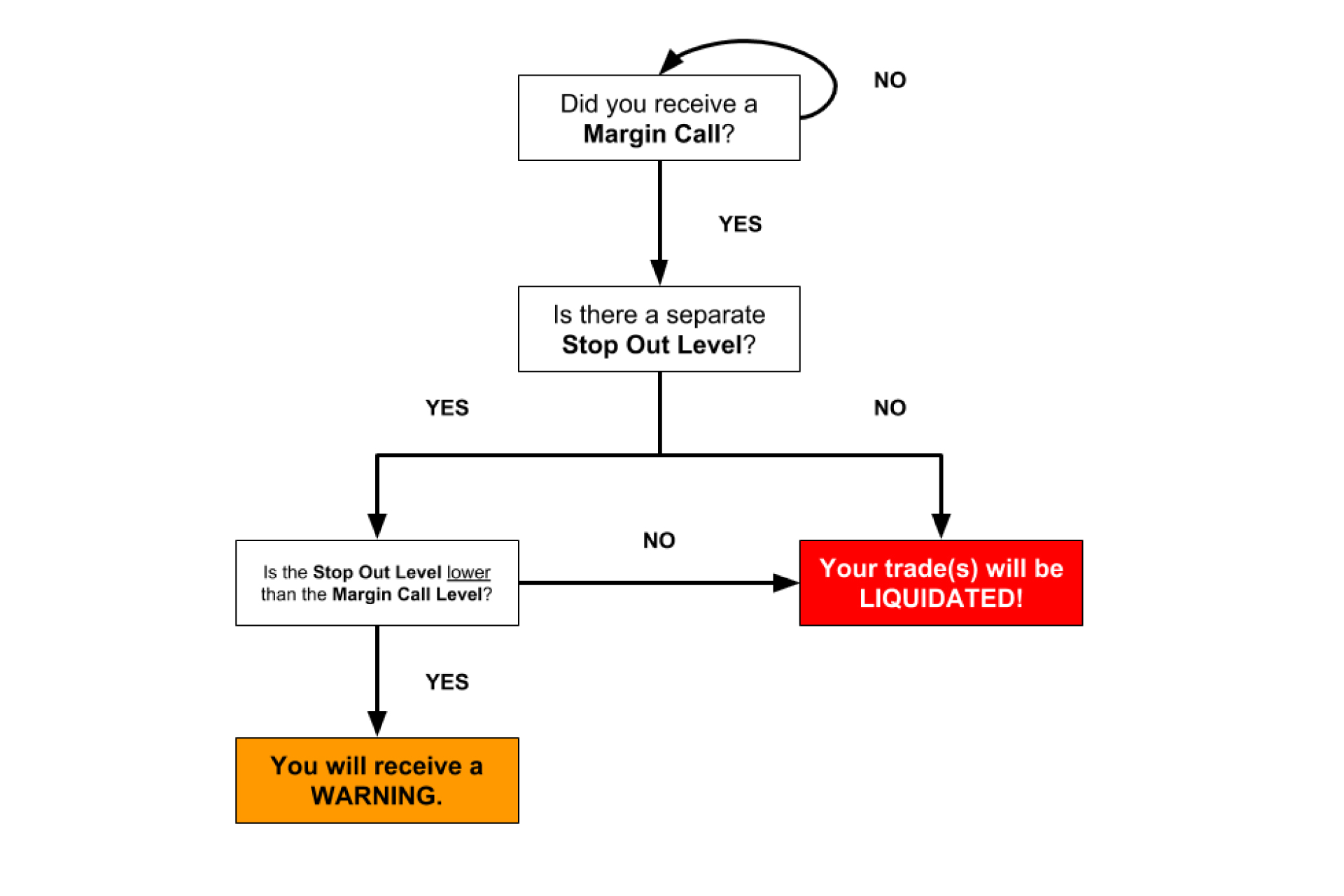

Depending on the broker, a “Margin Call” can be one of two things:

- If there is a separate Stop Out, your broker sends you a warning that your account equity has dropped below the required Margin Level percentage, There is no Equity to support your open positions any further.

- If there is no separate Stop Out, your broker automatically closes your trades, starting from the least profitable one until the required Margin Level is met.

If you receive a Margin Call, and don’t know your fate, here’s a diagram to help you know what will happen to your trade(s).

When there is a separate Margin Call and Stop Out Level, think of the Margin Call as a “warning shot” and the Stop Out as the automated action to minimize the chance of your account resulting in a negative balance.

Since you get a “warning shot”, this gives traders more time to manage their positions before the automatic liquidation of those positions occurs.

This is different from the traditional margin call policy where the Margin Call and Stop Out Level are one and the same. No “warning shot” is given. You simply just get “shot” (automatic liquidation).

In the end, it is ultimately YOUR responsibility to ensure that your account meets the margin requirements and in the event that if it is not met, your broker has the right to liquidate (“Stop Out”) any or all your open positions.

With a solid understanding of margin trading and the use of stop losses, proper position sizing, and risk management, a Stop Out can be easily prevented.

Margin Calls and Stop Outs occur due to overleveraging. Using more leverage can increase your gains, but it can also increase losses, which will quickly deplete your Free Margin. The more leverage you use, the faster your losses can accumulate.